2026 Payment Industry Trends: Stablecoins, Agentic Commerce, and Interchange Wars Reshape Digital Transactions

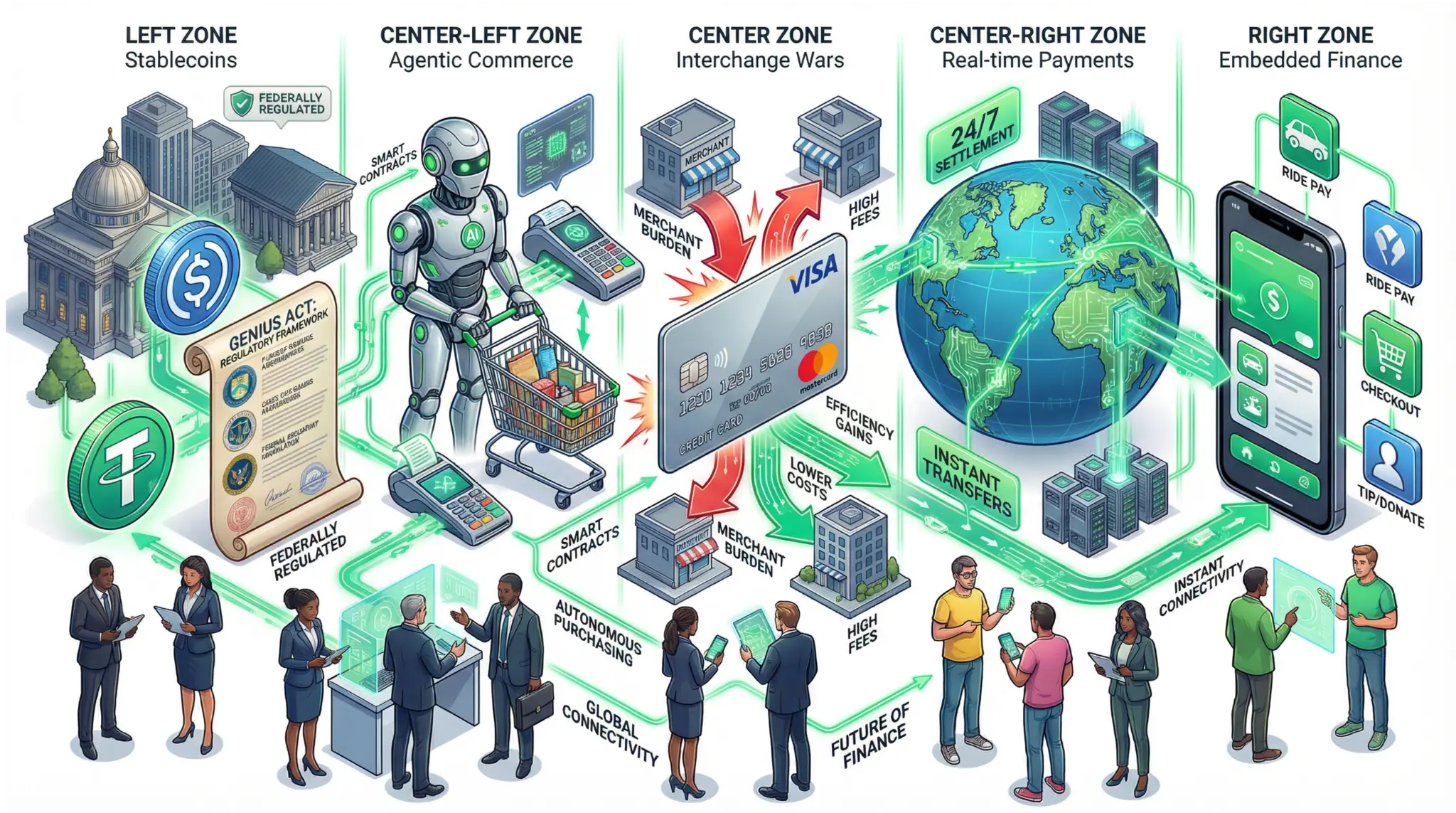

As the payments industry enters 2026, a confluence of technological innovations and regulatory shifts is fundamentally reshaping how transactions are processed and settled. Industry analysts have identified five critical trends that will define the payments landscape in 2026: stablecoins coming into their own, agentic commerce emerging as AI-driven shopping tools, interchange wars heating up between card networks and merchants, real-time payments expanding globally, and embedded finance becoming invisible infrastructure [1].

The most significant of these trends is the maturation of stablecoins as a payment mechanism. Following the passage of the GENIUS Act in July 2025, which established a clear regulatory framework for stablecoin issuers, stablecoins are now positioned to become the standard settlement mechanism for digital payments. This represents a fundamental shift from the speculative trading focus that has dominated the crypto industry for years to a focus on practical utility in payments and settlement [1].

Agentic commerce represents another transformative trend. As artificial intelligence continues to advance, AI-driven shopping tools are beginning to emerge that can autonomously make purchasing decisions on behalf of users. These agents will require seamless, low-friction payment mechanisms, and stablecoins are ideally positioned to serve this role. The combination of agentic commerce and stablecoin payments could fundamentally reshape e-commerce in 2026 and beyond [1].

| 2026 Payment Trends | Key Characteristics | Market Impact |

|---|---|---|

| Stablecoins | GENIUS Act compliance, regulatory clarity | Mainstream adoption. |

| Agentic Commerce | AI-driven shopping, autonomous agents | E-commerce transformation. |

| Interchange Wars | Card networks vs. merchants, fee pressure | Margin compression. |

| Real-Time Payments | 80+ countries with instant schemes | Global expansion. |

| Embedded Finance | Invisible infrastructure, seamless integration | Ubiquitous payments. |

| Expected Growth | 15-20% payment volume increase | Significant market expansion. |

The interchange wars represent a critical trend that will impact payment networks and merchants alike. For years, payment networks like Visa and Mastercard have charged merchants interchange fees to process credit card transactions. However, the emergence of alternative payment methods (including stablecoins and real-time payment systems) is creating pressure on these fees. Merchants are increasingly pushing back against high interchange fees, and regulators are beginning to scrutinize these fees more closely [1].

Real-time payments are expanding globally, with over 80 countries now operating instant payment schemes. These schemes enable payments to be settled in near-real-time, rather than the traditional T+1 or T+2 settlement timelines. The expansion of real-time payments is creating pressure on traditional payment networks and is accelerating the adoption of stablecoins as a settlement mechanism [1].

Embedded finance represents another critical trend. Rather than requiring users to navigate to a separate payment app or website to make a payment, embedded finance integrates payment functionality directly into the applications and services that users are already using. This seamless integration is expected to drive significant growth in digital payments in 2026 [1].

For traders, quants, and investors, these payment industry trends are significant for several reasons. First, they suggest that stablecoins are transitioning from a speculative asset to a core piece of financial infrastructure. Second, they indicate that payment networks like Visa and Mastercard face significant competitive pressure from alternative payment methods. Third, they suggest that the payments industry is undergoing a fundamental transformation driven by technology and regulation. Fourth, they create significant opportunities for fintech companies and service providers building stablecoin-based payment infrastructure [1].

The trends also have implications for specific companies and asset classes. Visa and Mastercard may face margin pressure as interchange fees come under scrutiny. Stablecoin issuers like Tether and Circle may see significant growth in transaction volumes as stablecoins become the standard settlement mechanism for digital payments. Fintech companies building stablecoin-based payment infrastructure may see significant growth opportunities [1].

References

[1] How Payments Will Evolve: 6 Industry Trends to Watch in 2026