STABLES INTELLIGENCE

Tether Launches USA₮: The First Federally Regulated Stablecoin Marks a Watershed Moment for Digital Dollars

Tether launches USA₮, the first federally regulated stablecoin under the GENIUS Act framework, issued by Anchorage Digital Bank with Cantor Fitzgerald custody, marking a watershed moment in stablecoin legitimization.

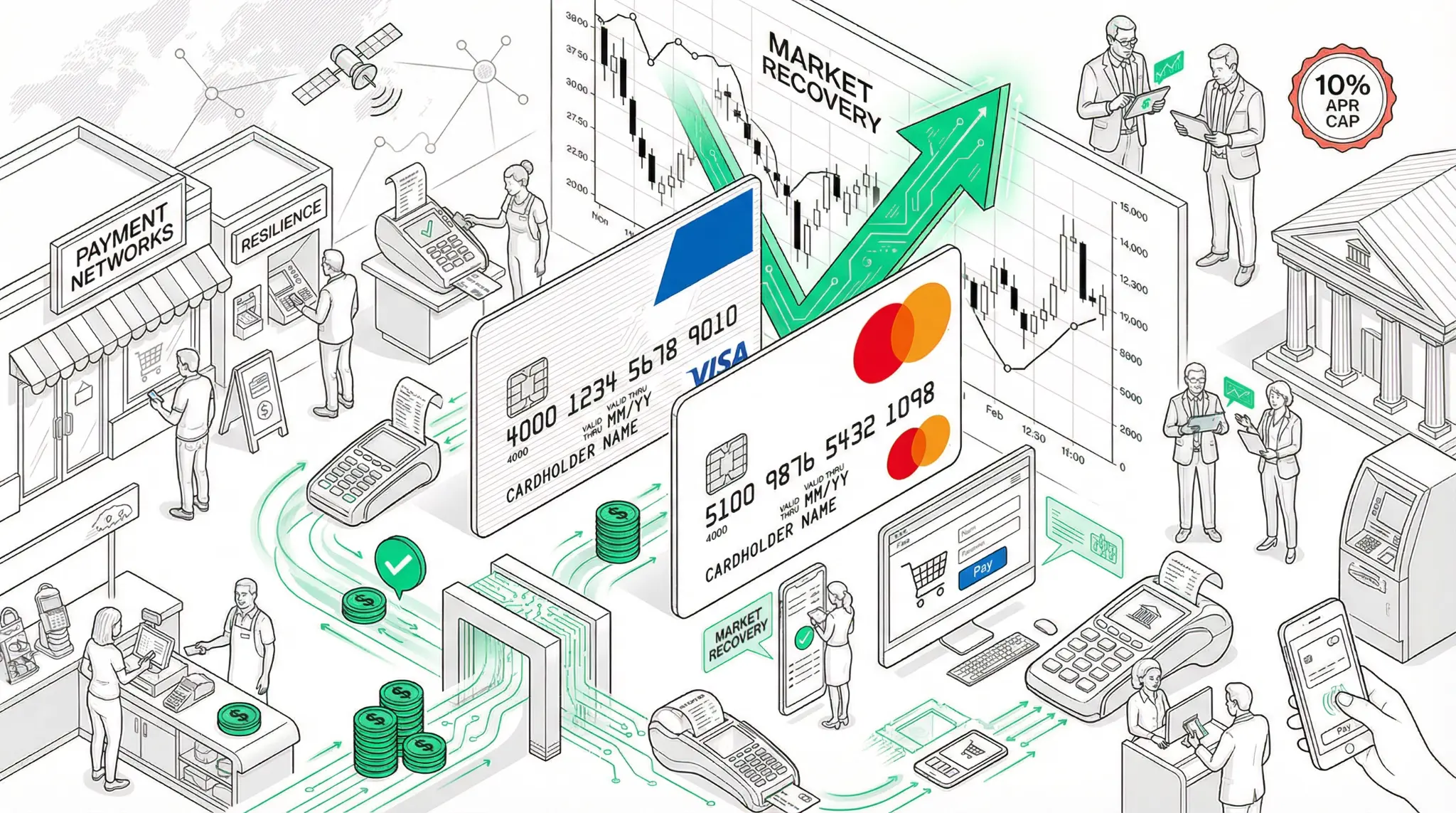

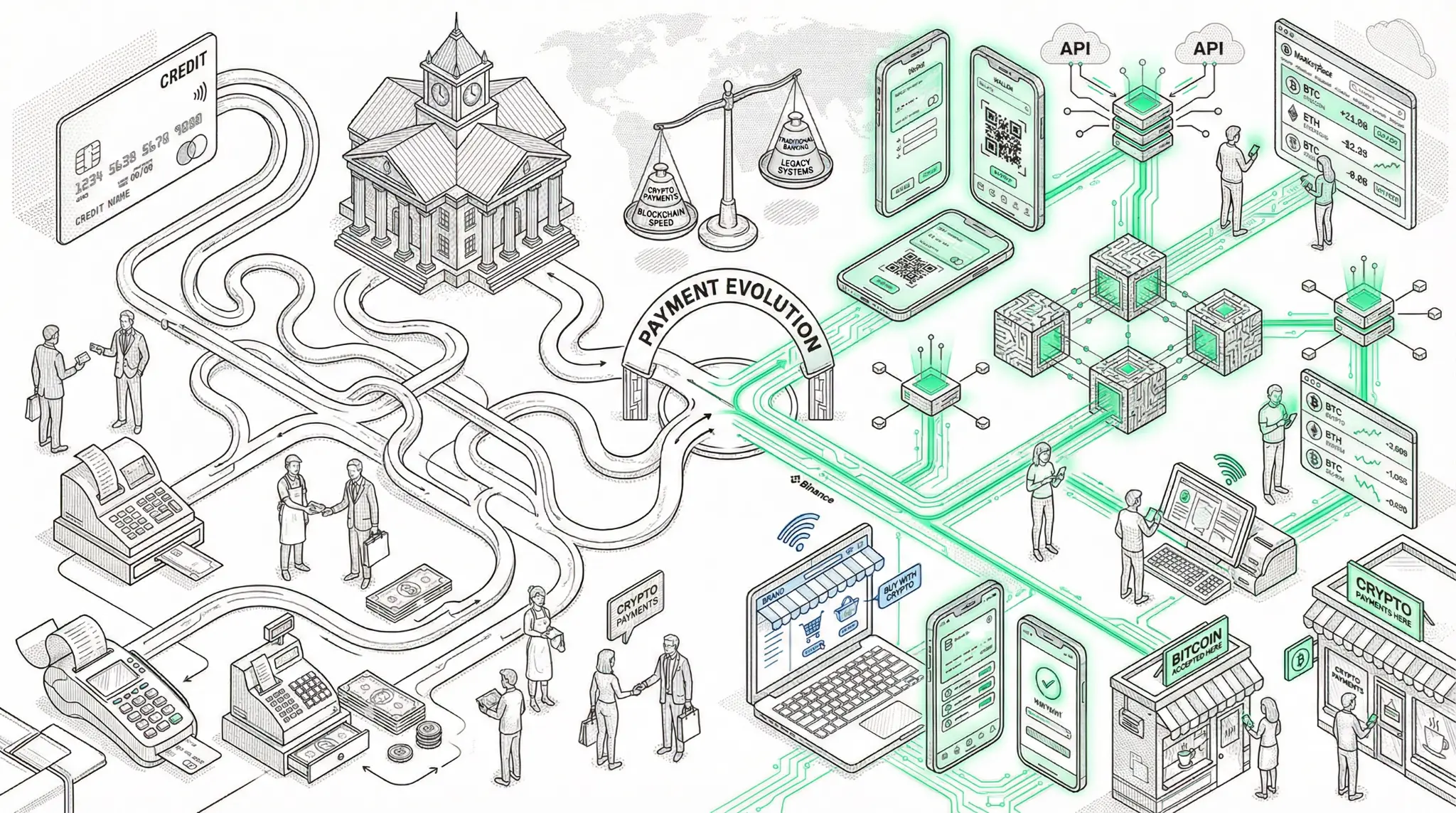

2026 Payment Industry Trends: Stablecoins, Agentic Commerce, and Interchange Wars Reshape Digital Transactions

Jan 30$20 Billion in Tokenized Securities Now On-Chain: The TradFi-Crypto Convergence Accelerates as Wall Street Embraces Blockchain

Jan 30Tokenized Gold Hits $5.8 Billion Market Cap: Paxos and Tether Lead the Real-World Asset Revolution

Jan 29USDT Demand Stalls as Tether Burns $3 Billion: Is the Stablecoin King Losing Its Crown?

Jan 29Crypto Adoption Reaches 39% in US Retail: Stablecoins and Fintech Drive Mainstream Payments Inflection Point

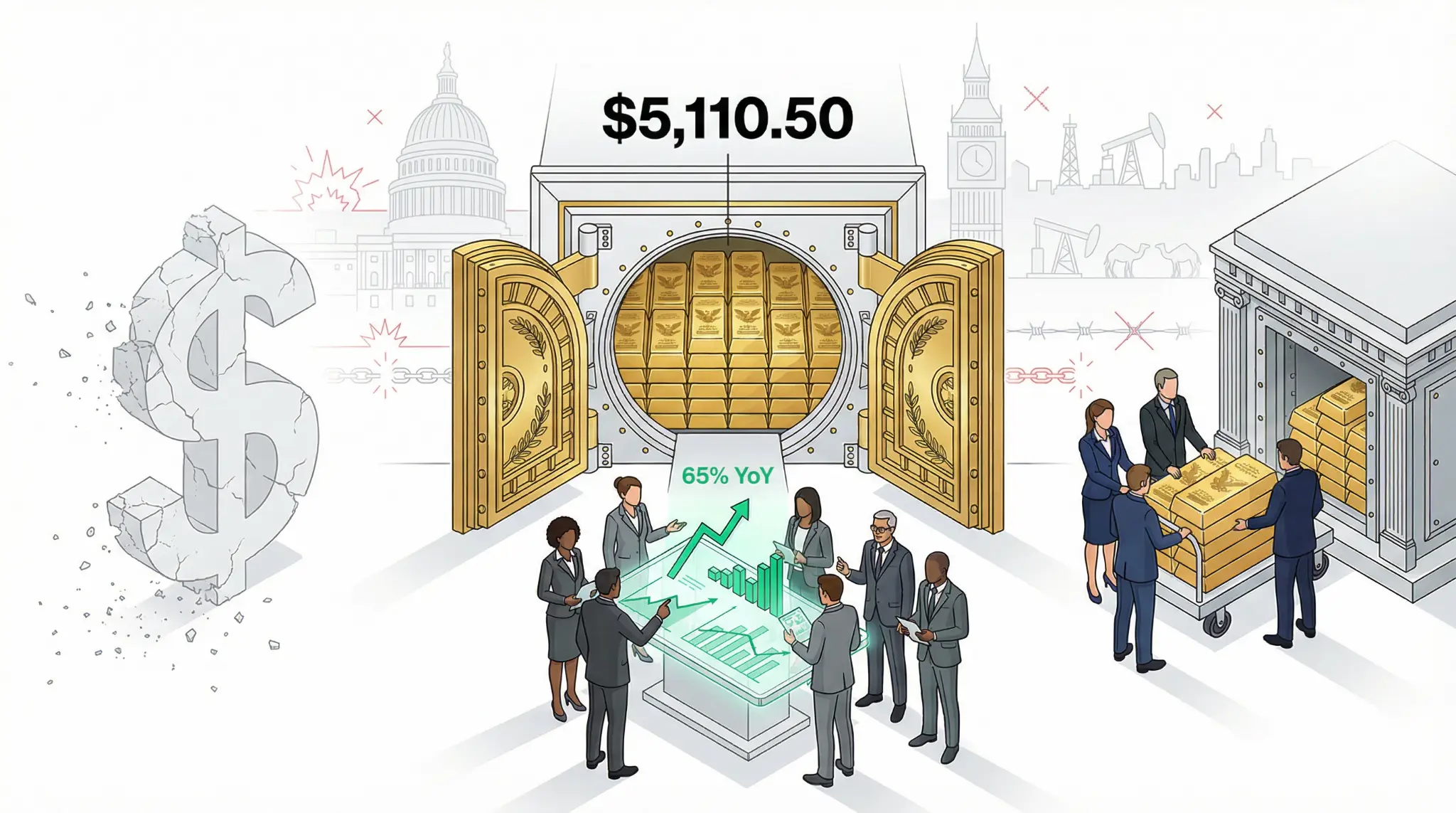

Jan 29Gold Tumbles from $5,600 Peak to $5,300: Precious Metals Rally Enters 'Dangerous Phase' as Profit-Taking Accelerates

Jan 29London Tokenisation Summit (TOK26) Convenes Major Financial Institutions: FCA, SEC, JP Morgan, Deutsche Bank, Barclays, Citi Gather to Scale Adoption

Jan 29Deutsche Bank Forecasts Gold at $6,000 in 2026: Investment Bank Sees Further Upside Despite Recent Pullback

Jan 28Flutterwave Explores Stablecoin Wallets: Africa's Leading Fintech Launches Secure USDC/USDT Balances for Cross-Border Payments

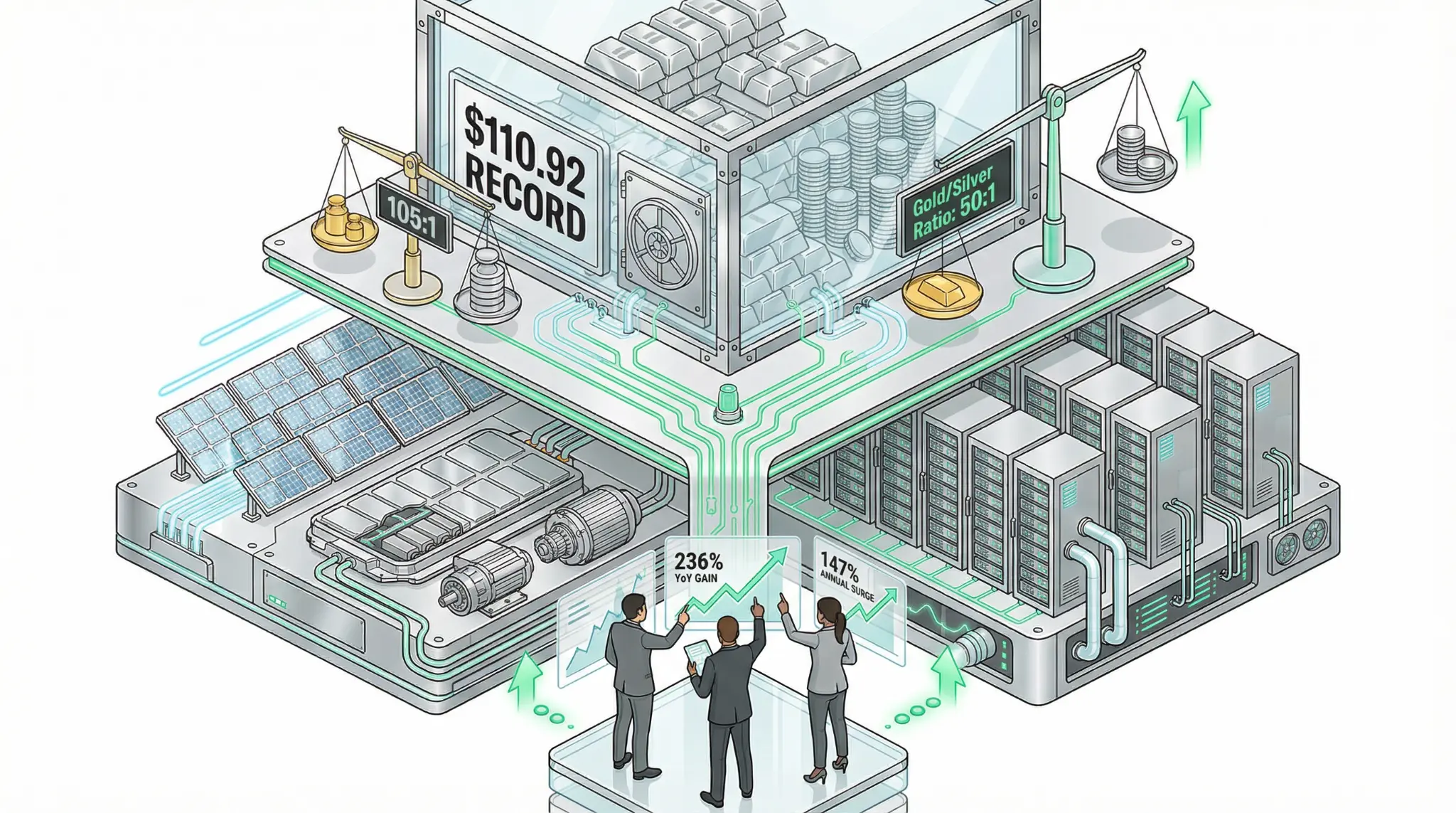

Jan 28Citi Predicts Silver at $150 Per Ounce Within 3 Months: Industrial Demand and China Buying Drive Bullish Case

Jan 28

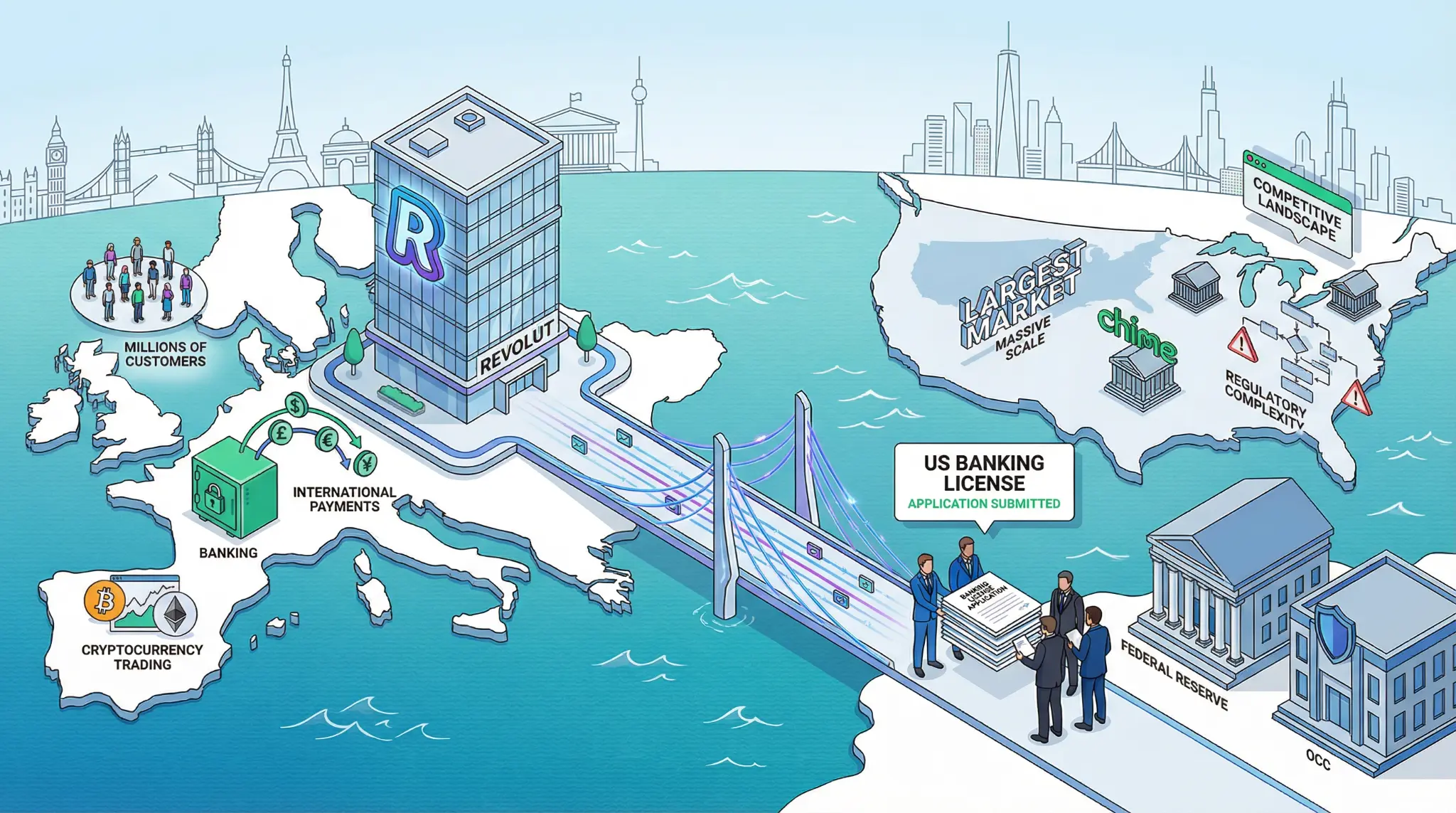

Revolut Applies for US Banking License: European Neobank Seeks to Expand into America's Largest Market

In a strategic move that signals the global ambitions of Europe's leading neobank, Revolut has announced that it is applying for a banking license in the United States, seeking to expand its operations into America's largest and most competitive financial services market. The application represents a significant milestone for Revolut and could accelerate the adoption of neobanking in the United States.

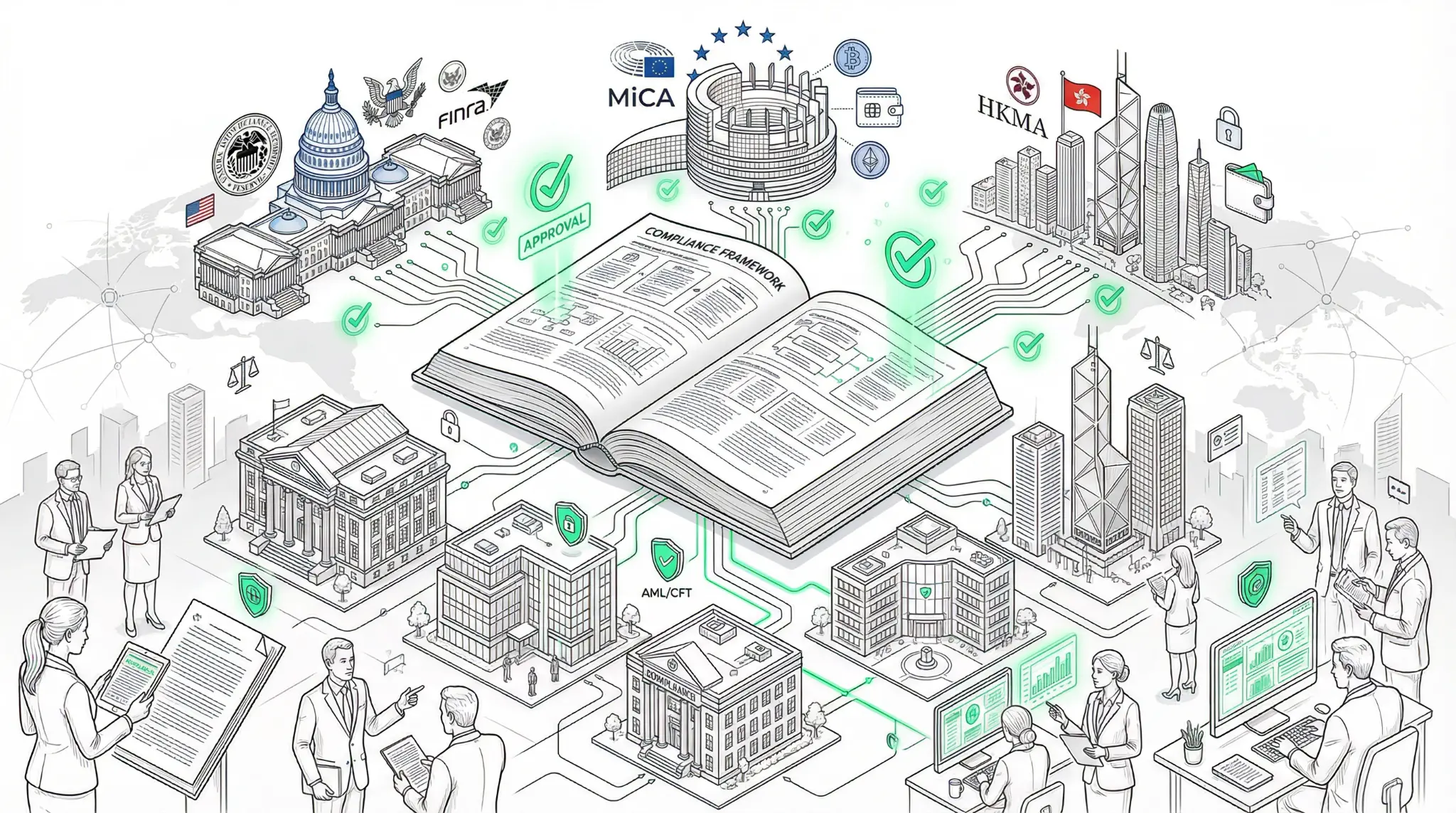

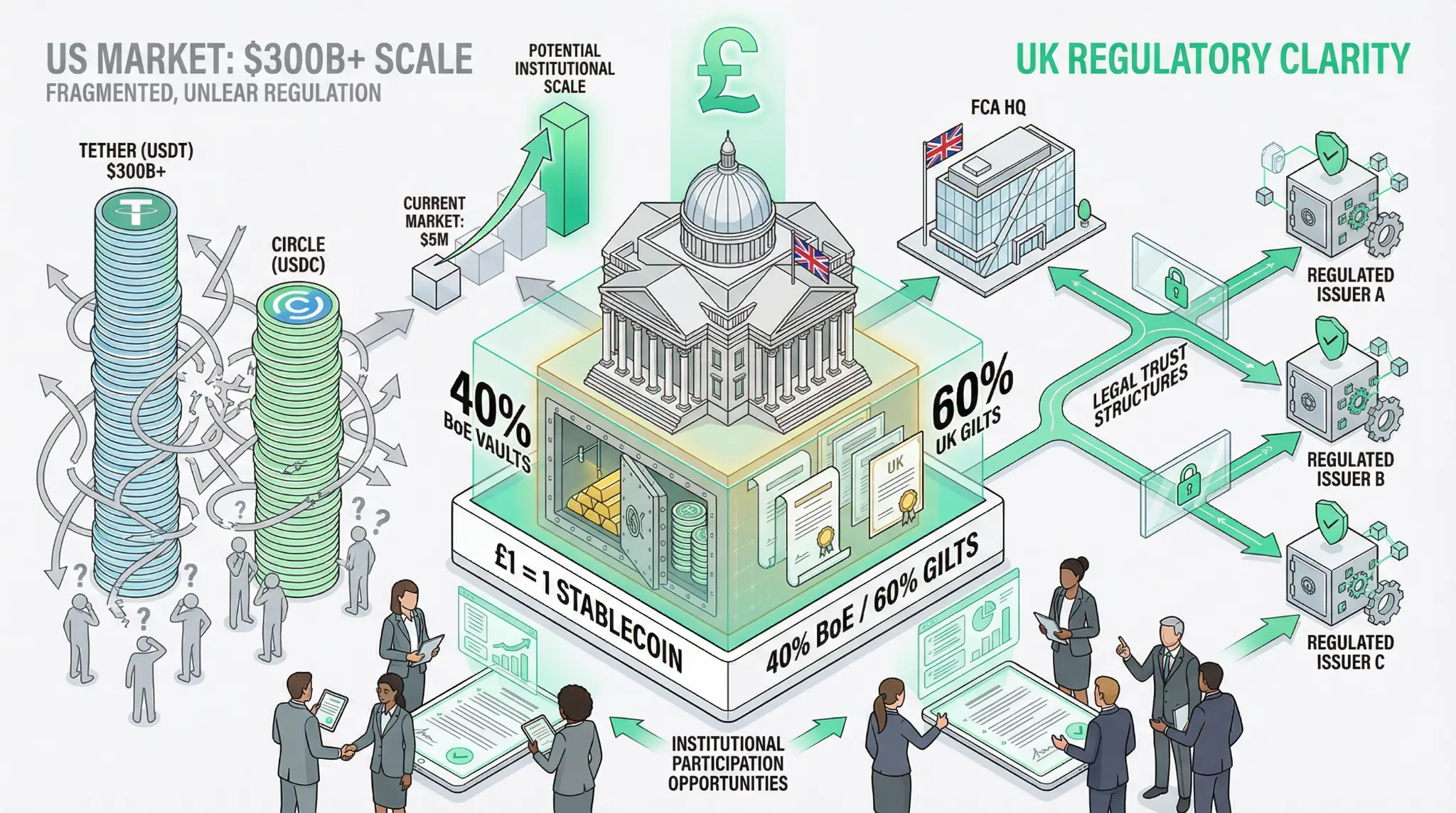

FCA Declares Sterling Stablecoins Top Priority: UK Sets Clear Regulatory Framework While US Remains Fragmented

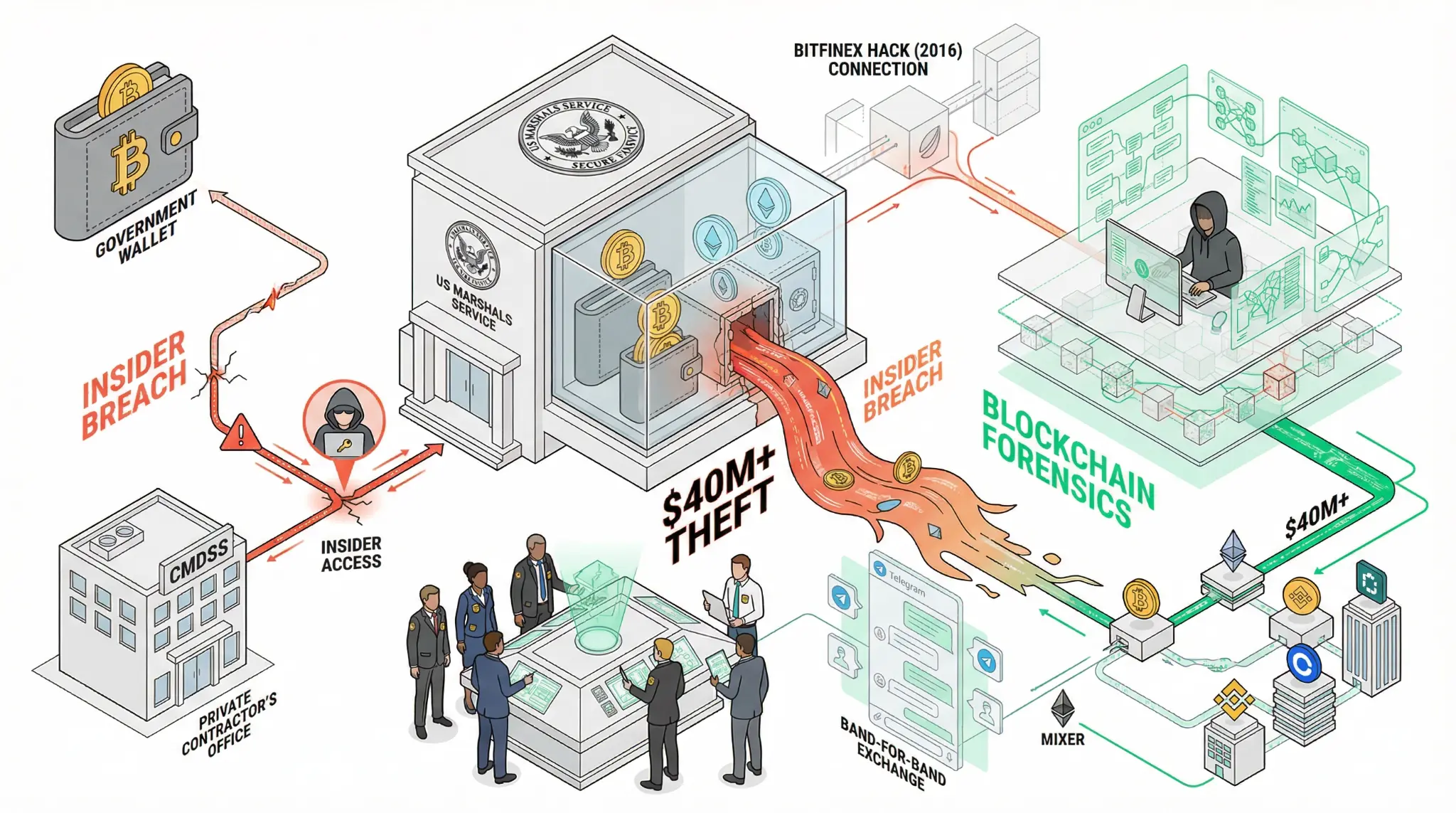

U.S. Marshals Service Hit by $40M+ Insider Theft: Government Custody Breach Exposes Risks of Centralized Asset Management

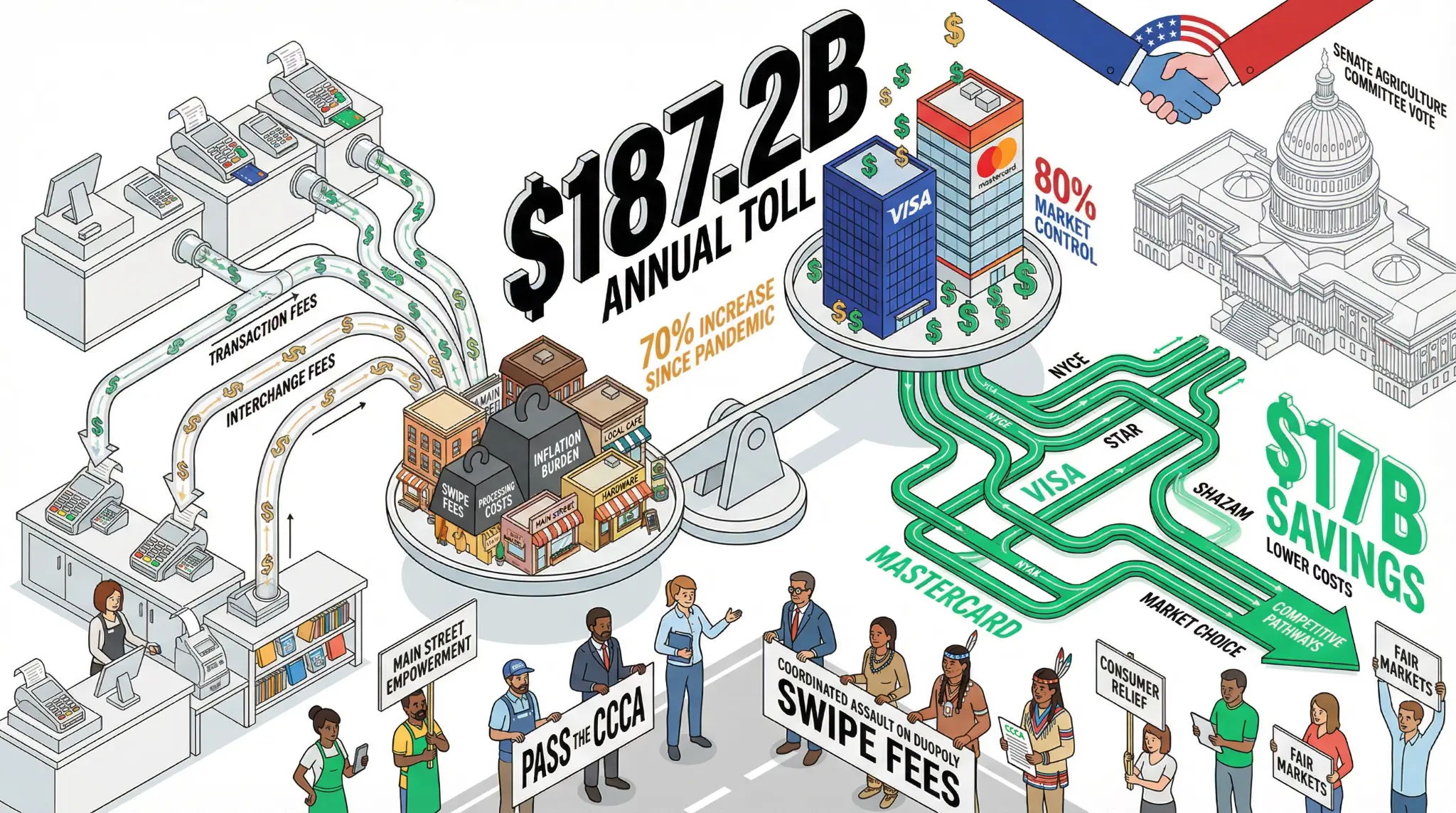

Merchants Coalition Launches Assault on Credit Card Swipe Fees: $187.2B Annual Toll Faces Congressional Challenge

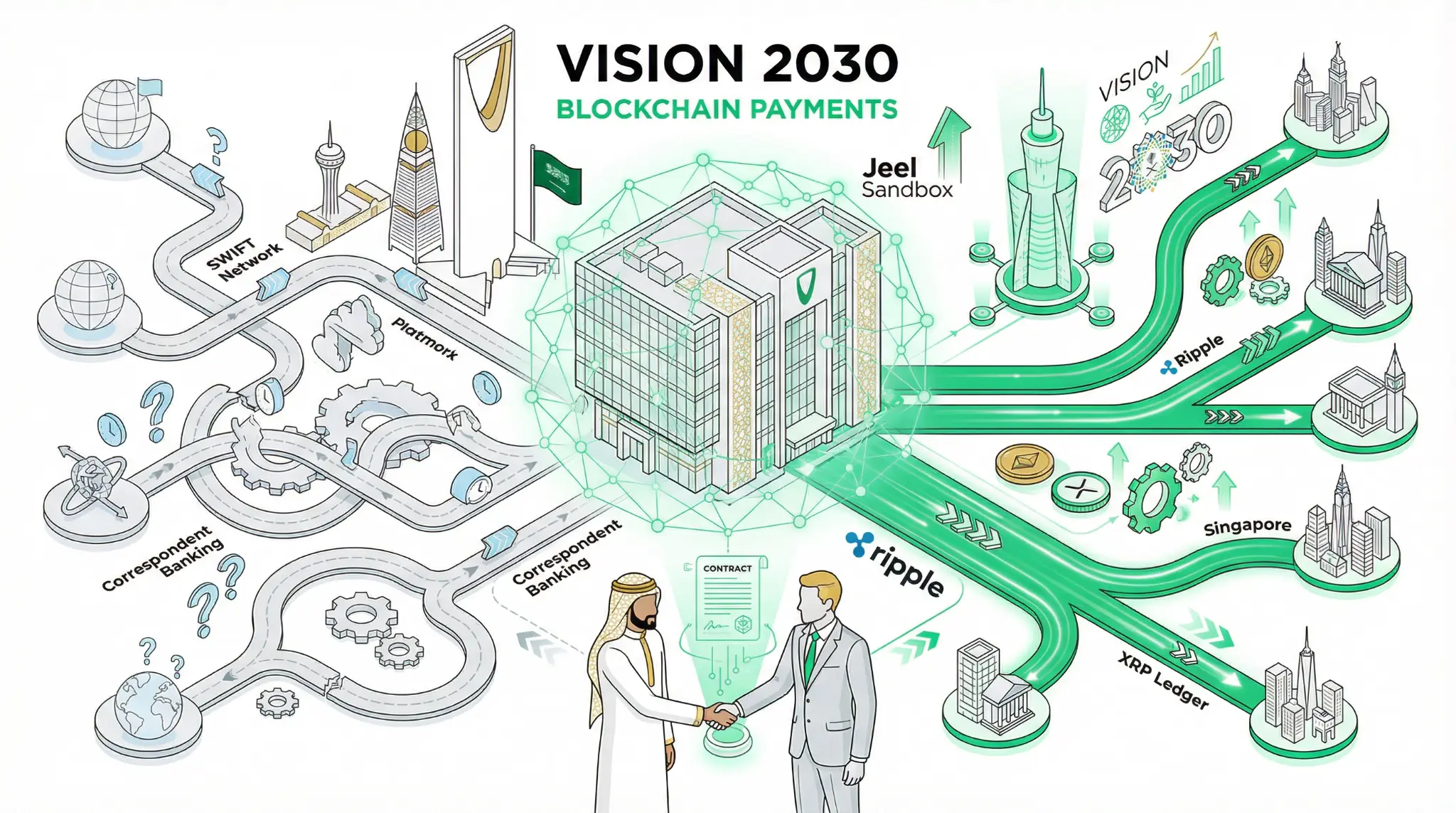

Ripple Partners with Riyad Bank's Jeel: Saudi Arabia's Vision 2030 Goes Blockchain

MEXC and Ether.fi Launch Co-Branded Crypto Card: 4% Cashback Brings Self-Custody to 150M+ Merchants

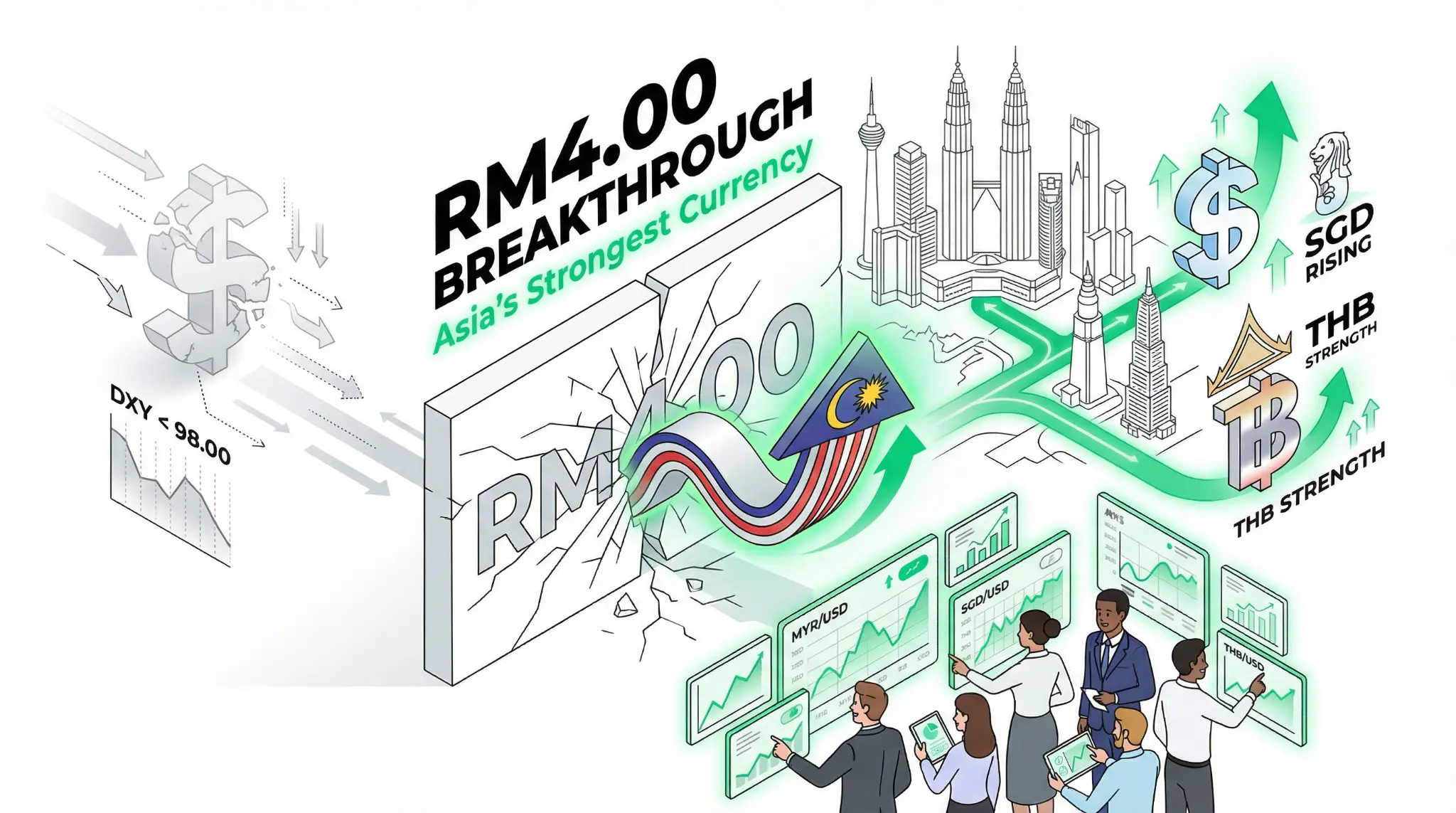

Malaysian Ringgit Breaks Below RM4.00: Asia's Strongest Currency Signals Pivot Away from Dollar

Jan 26

Silver Explodes to Record $110: The Industrial Metal Outpaces Gold in Historic Surge

Jan 26

Gold Smashes Through $5,100 for First Time: The Safe-Haven Surge Reflects a Deepening Crisis of Confidence

Jan 26

Cryptocurrency Payments Could Outpace Traditional Methods: Binance Analysis Shows the Tipping Point Approaching

Jan 23Sumsub and GOE Alliance Sign MoU at Davos: Compliant Crypto Payments Coming to Vietnam

Sumsub and the GOE Alliance have signed a Memorandum of Understanding (MoU) at the World Economic Forum in Davos to support the development of compliant crypto payment infrastructure in Vietnam. This partnership represents a convergence of compliance expertise, regulatory understanding, and market opportunity that could accelerate the adoption of cryptocurrency payments across Southeast Asia.

ICMA Examines Stablecoins as Capital Markets Infrastructure: 24/7 On-Chain Settlement is the Future

The International Capital Market Association (ICMA) has published a detailed paper examining stablecoins as settlement assets for capital markets. The paper argues that stablecoins have the potential to unlock 24/7 on-chain settlement, provide liquidity outside traditional market cycles, and extend fixed income products to new wholesale and retail markets.