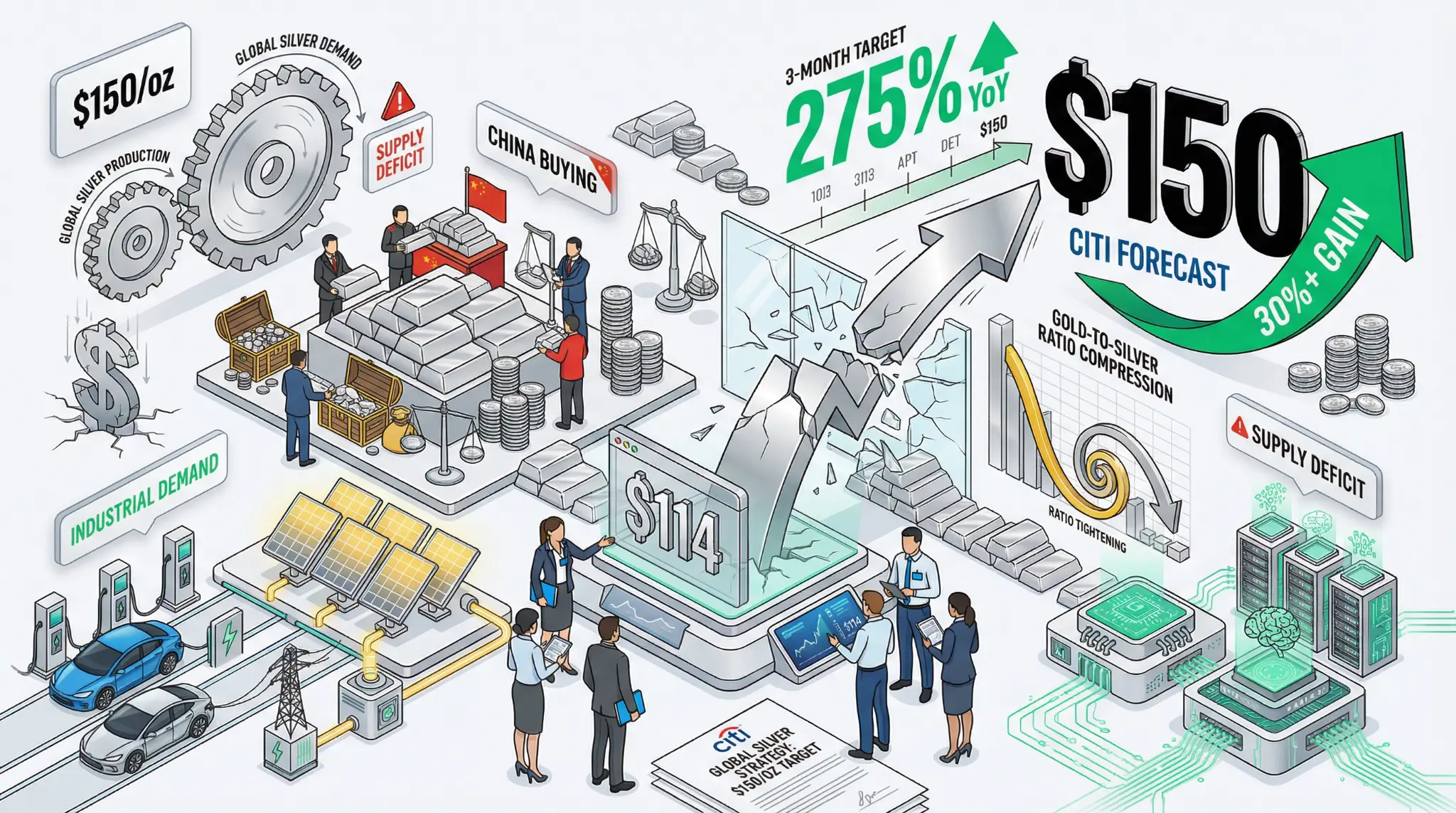

Citi Predicts Silver at $150 Per Ounce Within 3 Months: Industrial Demand and China Buying Drive Bullish Case

In a remarkably bullish forecast that suggests silver could appreciate another 30%+ from current levels, Citigroup has predicted that silver will reach $150 per ounce within three months. The forecast is based on several key factors: continued China buying, persistent dollar weakness, and surging industrial demand from electric vehicles, solar panels, and AI data centers.

Citi's $150 forecast is particularly significant because it comes at a time when silver is already trading near record highs above $114 per ounce. The forecast suggests that Citi believes the fundamental drivers supporting silver prices are not only intact but accelerating. If silver reaches $150, it would represent a 275%+ year-over-year gain and would be one of the most extraordinary rallies in the history of the precious metals market.

"Silver is poised for further appreciation driven by China's continued buying, persistent dollar weakness, and surging industrial demand. We believe silver could reach $150 per ounce within three months," Citi analysts said in their forecast.

The forecast is based on several key drivers. First, China has been a massive buyer of precious metals in recent years as it seeks to diversify its foreign exchange reserves away from dollar-denominated assets. This buying has been a significant support for both gold and silver prices. Second, the dollar has been weakening significantly, which makes dollar-priced commodities like silver more attractive to international buyers. Third, industrial demand for silver has been surging due to the rapid growth of electric vehicles, solar panels, and AI data centers, all of which require significant amounts of silver.

Forecast Analysis

| Citi Silver Forecast Metric | Figure | Significance |

|---|---|---|

| 3-Month Price Target | $150 per ounce | 30%+ upside from current levels |

| Current Price (Jan 28) | ~$114 per ounce | Starting point for forecast |

| YoY Performance | +275% | Extraordinary rally |

| YTD Performance | +65% (Jan 2026) | Strong momentum |

| Key Driver 1 | China buying | Structural demand |

| Key Driver 2 | Dollar weakness | Currency tailwind |

| Key Driver 3 | Industrial demand | EV, solar, AI growth |

| Key Driver 4 | Supply deficit | Structural shortage |

The forecast also has implications for the technical structure of the silver market. Silver had been trading in a strong uptrend, with each pullback attracting new buyers. If silver is able to break through the $120 resistance level and establish a new trading range above that level, it could set up a move toward $150. However, if silver fails to break above $120 and instead consolidates, the $150 target could be delayed.

The forecast also has implications for the competitive dynamics of the precious metals market. The gold-to-silver ratio has been compressing dramatically, which suggests that silver is outperforming gold. If Citi's forecast proves correct and silver reaches $150, the ratio could compress even further, which could attract additional capital into silver.

For traders, quants, and investors, Citi's $150 forecast is significant for several reasons. First, it represents a major investment bank's official view on the direction of silver prices. Second, it suggests that industrial demand for silver is accelerating faster than supply. Third, it indicates that China's buying activity is expected to continue supporting prices. Fourth, it provides a clear price target for investors who are bullish on silver.

The forecast also has implications for portfolio construction. Investors who are bullish on silver could use the $150 target as a price target for their positions. Investors who are bearish on silver could use the forecast as a contrarian indicator and position themselves for a pullback.

Related Articles

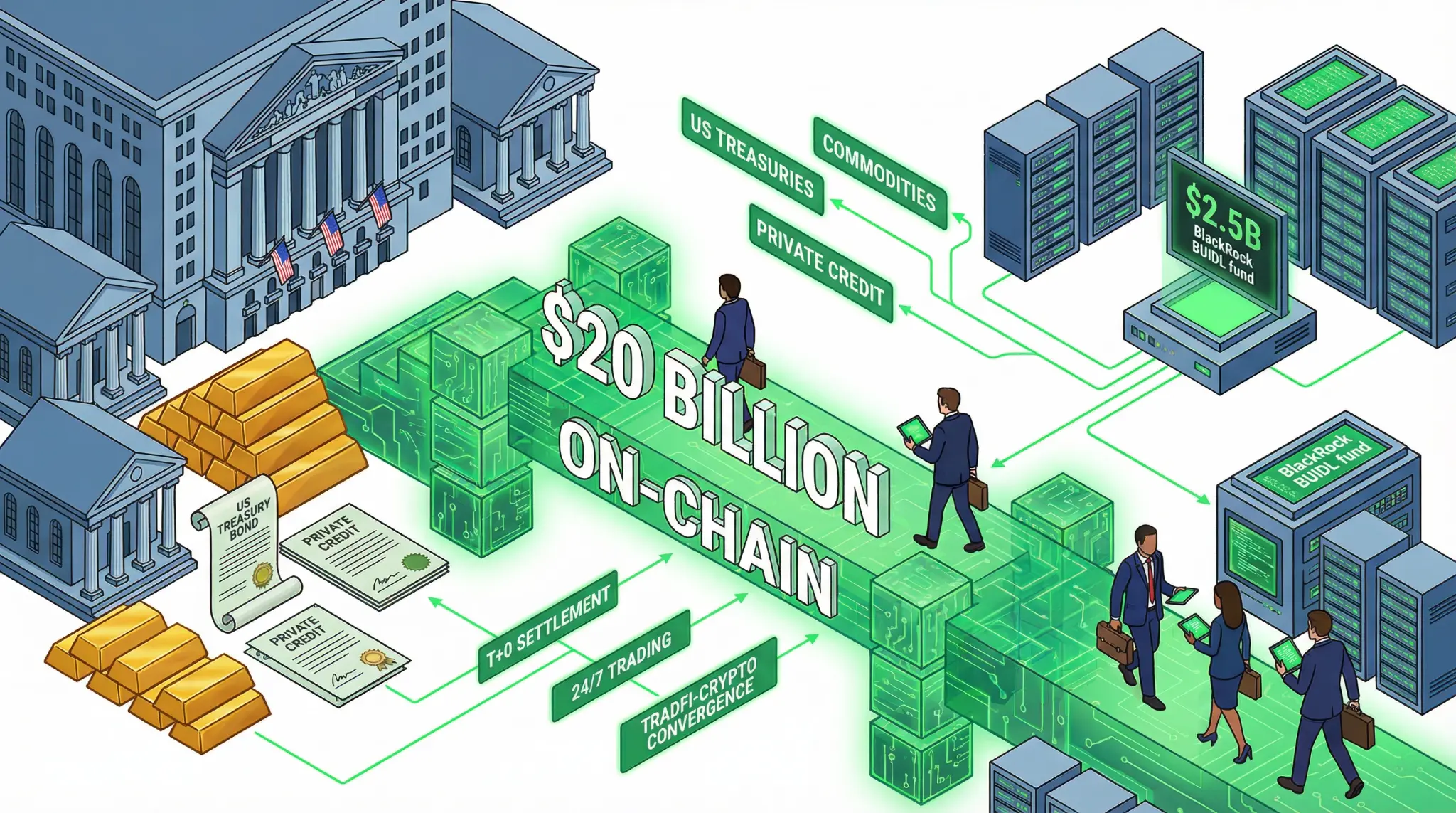

$20 Billion in Tokenized Securities Now On-Chain: The TradFi-Crypto Convergence Accelerates as Wall Street Embraces Blockchain

$20 billion in tokenized securities now on-chain, led by US Treasuries and BlackRock's $2.5B BUIDL fund, with Bernstein projecting 4x growth to $80B by year-end as TradFi-crypto convergence accelerates.

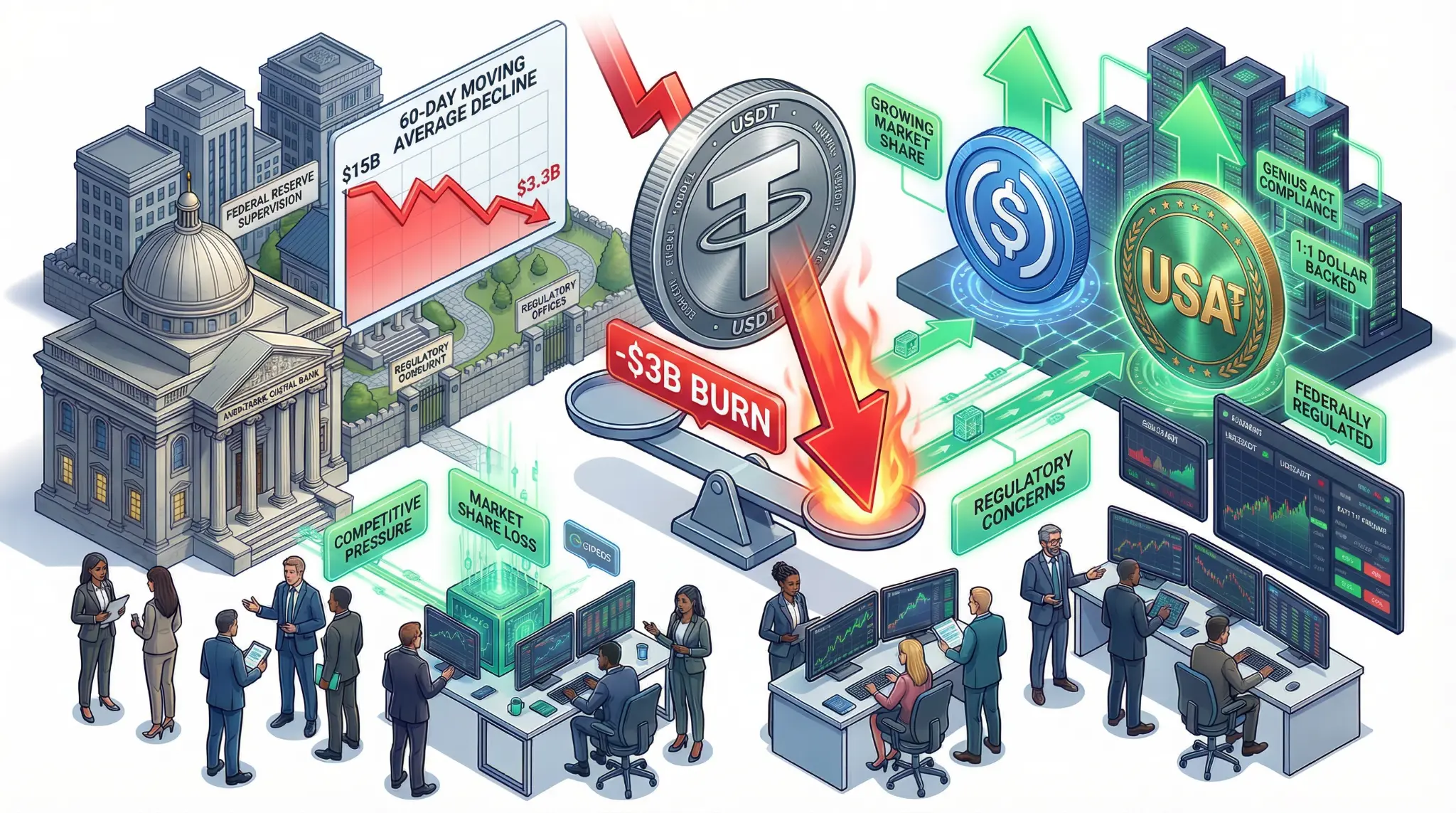

USDT Demand Stalls as Tether Burns $3 Billion: Is the Stablecoin King Losing Its Crown?

Tether's USDT stablecoin sees demand growth decline from $15B to $3.3B 60-day moving average, with $3B burned in January 2026, signaling potential market share shift to USDC and USA₮.

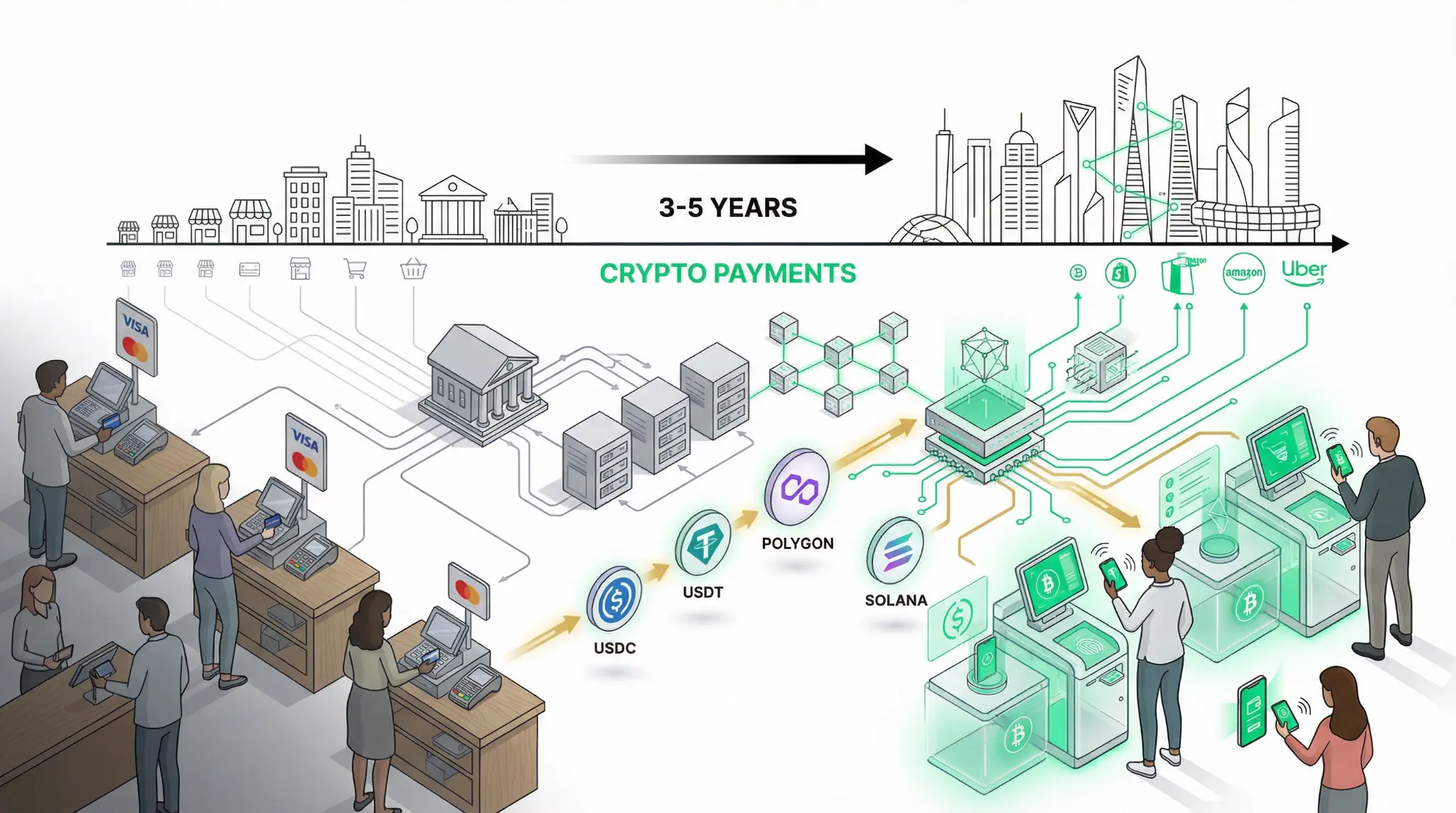

Crypto Adoption Reaches 39% in US Retail: Stablecoins and Fintech Drive Mainstream Payments Inflection Point

In a landmark report that demonstrates the accelerating mainstream adoption of cryptocurrency, AInvest has released analysis showing that cryptocurrency adoption in US retail payments has reached 39% in 2025, driven primarily by stablecoins and fintech platforms like PayPal. This represents a critical inflection point in the adoption curve, suggesting that cryptocurrency is transitioning from a niche asset to a mainstream payment method.