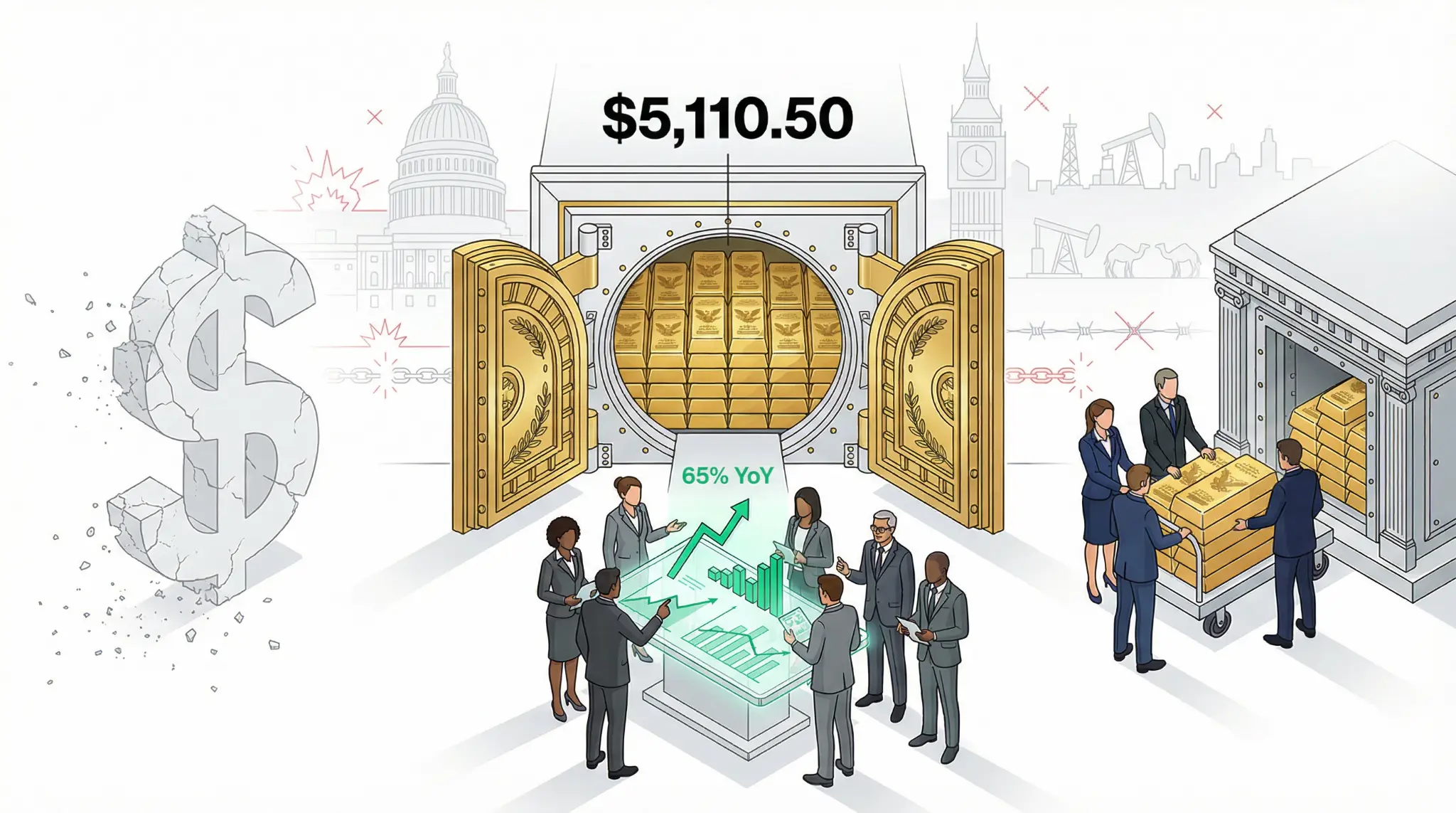

Gold Smashes Through $5,100 for First Time: The Safe-Haven Surge Reflects a Deepening Crisis of Confidence

January 26, 2026 - In a moment that will be etched into the annals of precious metals trading, gold surged past $5,100 per ounce for the first time in history on Monday, touching an intraday peak of $5,110.50 before settling around $5,086 [1]. This is not merely a price milestone; it is a signal that institutional and retail investors are collectively hedging against a world that feels increasingly unstable. The drivers are unmistakable: a weakening US dollar, escalating geopolitical tensions, and a growing crisis of confidence in the stability of the global financial order [1][2].

The significance of gold's breakthrough cannot be overstated. Gold does not produce earnings, does not pay dividends, and generates no cash flow. Yet investors are willing to pay record prices for it. This reveals something profound about market sentiment. When rational economic actors are willing to pay record prices for an asset that generates no yield, it means they are not investing; they are hedging. They are betting that the future holds uncertainty, inflation, or instability that makes a non-yielding asset preferable to the alternatives available in traditional finance.

"Gold is the inverse of confidence," Max Belmont, portfolio manager at First Eagle Investment Management, told Bloomberg. "The surging price for the safe-haven asset is a hedge against unexpected bouts of inflation, unanticipated drawdowns in the market, and flare-ups in geopolitical risk." [1]

The immediate catalyst for Monday's surge was a combination of factors that have become all too familiar in early 2026. President Trump's latest tariff threats—including a threat of a 100% tariff on Canada if it proceeds with a trade deal with China—have created a palpable sense of economic uncertainty. Trump's rhetoric on Truth Social was characteristically inflammatory: "China will eat Canada alive, completely devour it, including the destruction of their businesses, social fabric, and general way of life." These are not the words of a leader seeking to de-escalate trade tensions; they are the words of someone willing to use economic coercion as a primary tool of statecraft [1].

But the tariff threats are only part of the story. Geopolitical tensions have also escalated sharply. Trump's desire to annex Greenland, his threats against European nations, his plans for military action in the Middle East, and the ongoing situation in Venezuela have all contributed to a sense that the global order is becoming more fragmented and unstable. When geopolitical risk rises, capital flows into safe-haven assets. Gold is the ultimate safe-haven asset [2].

| Gold Market Metric | Figure | Significance |

|---|---|---|

| All-Time High (Jan 26) | $5,110.50 per ounce | Historic breakthrough, first time above $5,100. |

| Trading Range (Jan 26) | $5,086-$5,102 | Consolidation near record levels. |

| 2025 Annual Gain | 65% | Biggest annual gain since 1979. |

| YTD Gain (2026) | 18%+ | Strong start to 2026. |

| Goldman Sachs Target (Dec 2026) | $5,400 per ounce | Revised upward from $4,900. |

| Central Bank Buying | 60 tonnes/month | Far above pre-2022 average of 17 tonnes/month. |

| ETF Inflows (2025) | ~500 tonnes | Massive institutional demand. |

The weakness in the US dollar has also been a significant driver of gold's ascent. The dollar index (DXY) has fallen below 98.00, a technically pivotal level that signals potential for further dollar weakness. A weaker dollar makes gold more affordable for holders of other currencies, which expands the global demand base for the precious metal. Capital.com market analyst Daniela Hathorn noted that there is a "deepening crisis of confidence in the U.S. dollar and the broader monetary order" [1]. This is a stunning statement from a mainstream financial institution. It reflects a growing recognition that the dollar's role as the world's reserve currency is being challenged.

Central bank buying has also played a crucial role in supporting gold prices. Emerging market central banks are continuing to shift reserves into gold at a pace far above historical norms. Goldman Sachs estimates that central bank purchases now average around 60 tonnes per month, compared to a pre-2022 average of just 17 tonnes per month [2]. This is a structural shift in how central banks are managing their reserves. They are moving away from dollar-denominated assets and into gold, a move that signals a loss of confidence in the dollar and a desire to hold assets that are not subject to the monetary policy decisions of any single nation.

Goldman Sachs has revised its December 2026 gold price target to $5,400 per ounce, up from $4,900 previously. The firm argues that hedges against global macro and policy risks have become "sticky," meaning that investors are not likely to unwind these hedges quickly even if geopolitical tensions ease [2]. This suggests that gold could continue to appreciate even if the immediate catalysts for the current rally dissipate.

For traders, quants, and investors, gold's breakthrough above $5,100 is significant for several reasons. First, it signals that institutional investors are increasingly concerned about the stability of the global financial system. Second, it indicates that central banks are losing confidence in the dollar and are actively diversifying their reserves. Third, it suggests that the traditional relationship between interest rates and gold prices may be breaking down, as gold is appreciating even as real yields remain elevated. Fourth, it indicates that geopolitical risk is being priced into markets at levels not seen in years.

The question for investors is whether gold's rally has further to run. With Goldman Sachs targeting $5,400 by December 2026, there is still potential for significant appreciation from current levels. However, any reversal in geopolitical tensions or a strengthening of the dollar could trigger a sharp correction. The key is to monitor central bank buying patterns, dollar weakness, and geopolitical developments. As long as these three factors remain supportive, gold is likely to remain bid.

References

[1] Gold Surges Past Record $5,100–Silver Rises More Than 8% [2] Gold prices cross $5,100 for the first time amid geopolitical uncertainties

Related Articles

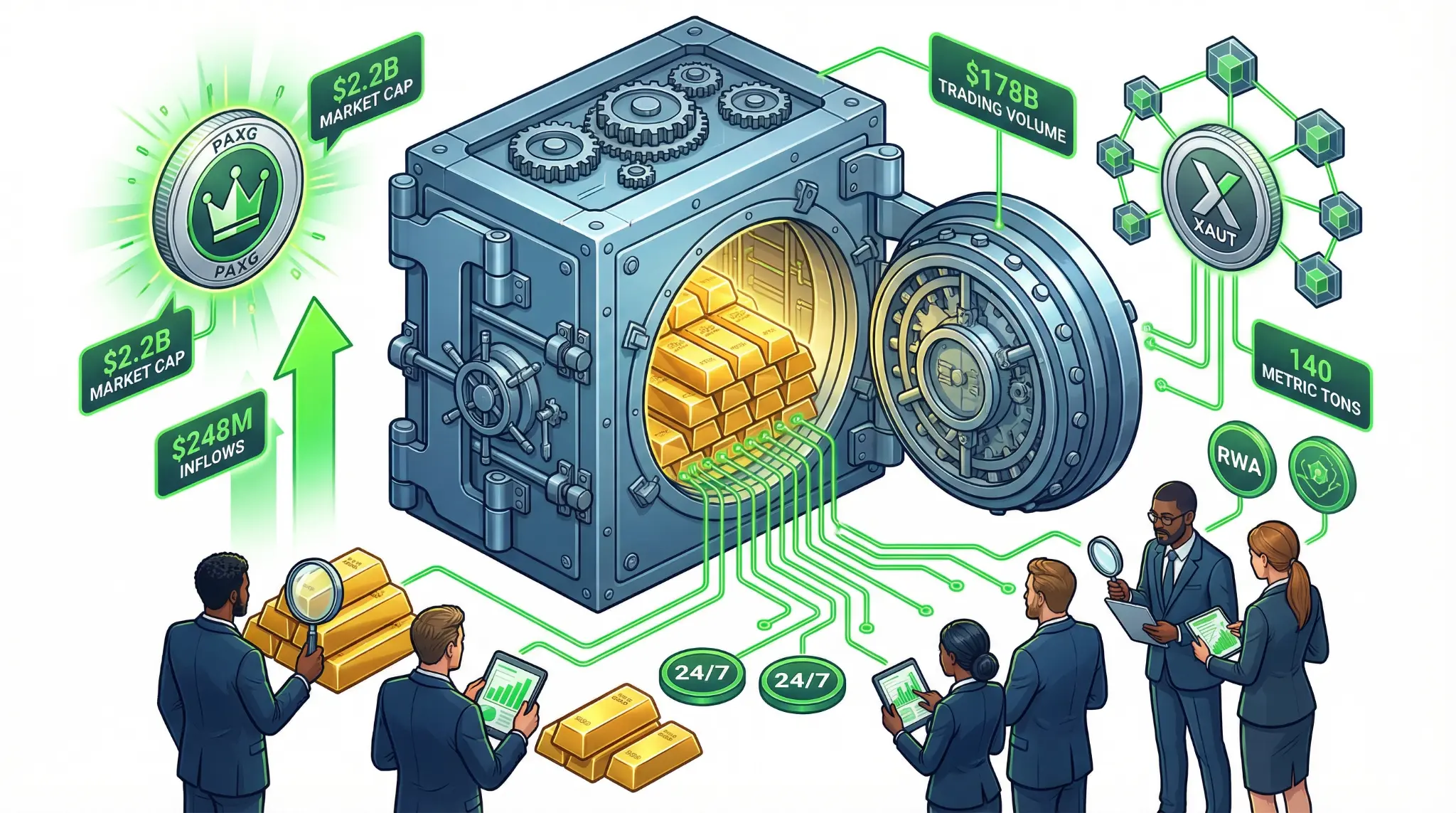

Tokenized Gold Hits $5.8 Billion Market Cap: Paxos and Tether Lead the Real-World Asset Revolution

Tokenized gold market reaches $5.8B market cap with $178B trading volume, led by Paxos Gold ($2.2B) and Tether XAUT (140 metric tons), marking major milestone in real-world asset tokenization.

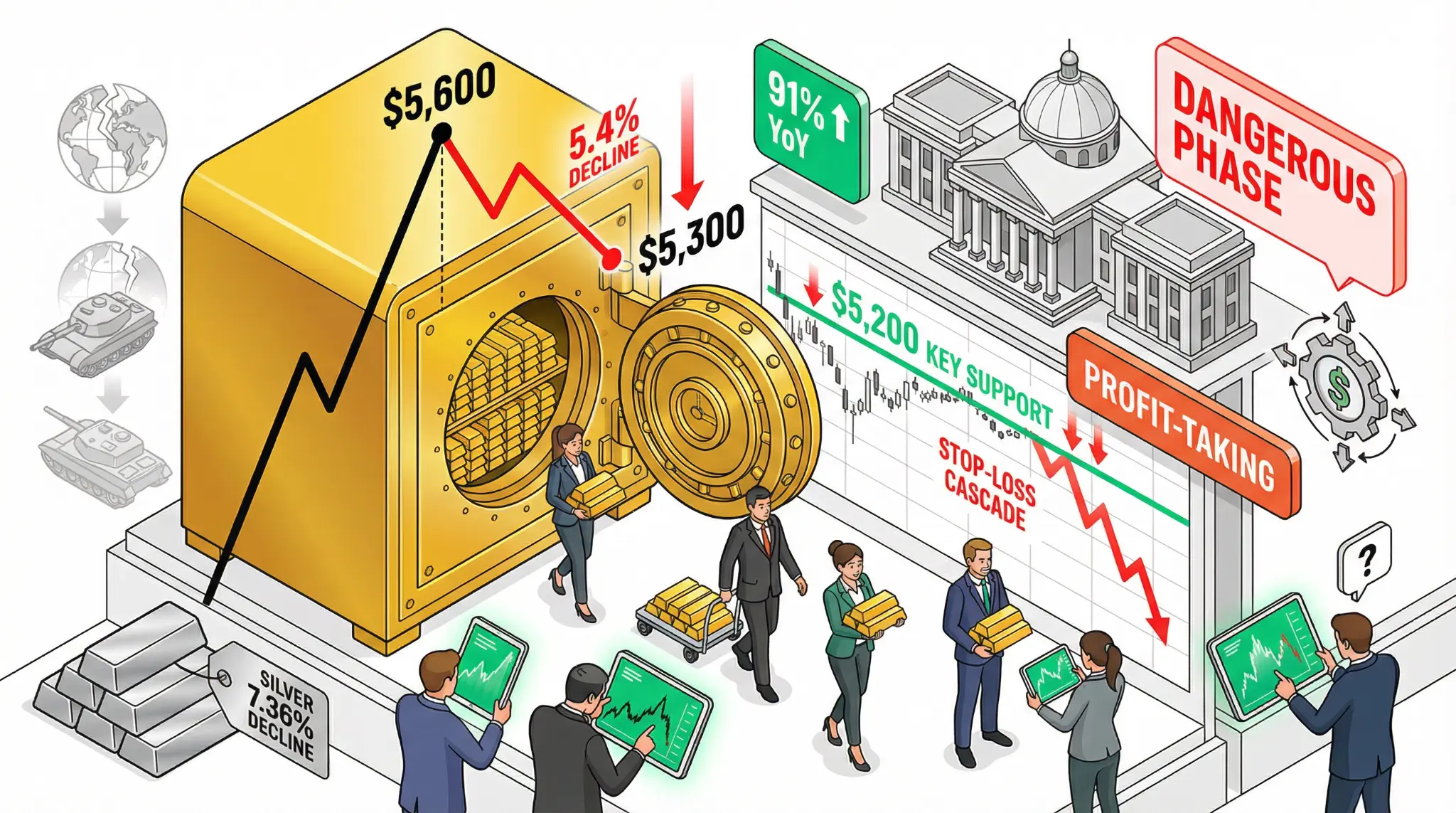

Gold Tumbles from $5,600 Peak to $5,300: Precious Metals Rally Enters 'Dangerous Phase' as Profit-Taking Accelerates

In a sharp reversal that has caught many investors off guard, gold has tumbled from its record peak above $5,600 per ounce to $5,300, a decline of approximately 5.4% in just days. The sharp correction has prompted analysts to warn that the precious metals rally is entering a 'dangerous phase' characterized by profit-taking and potential for further downside. Silver has been hit even harder, sinking 7.36% from its highs above $120 per ounce.

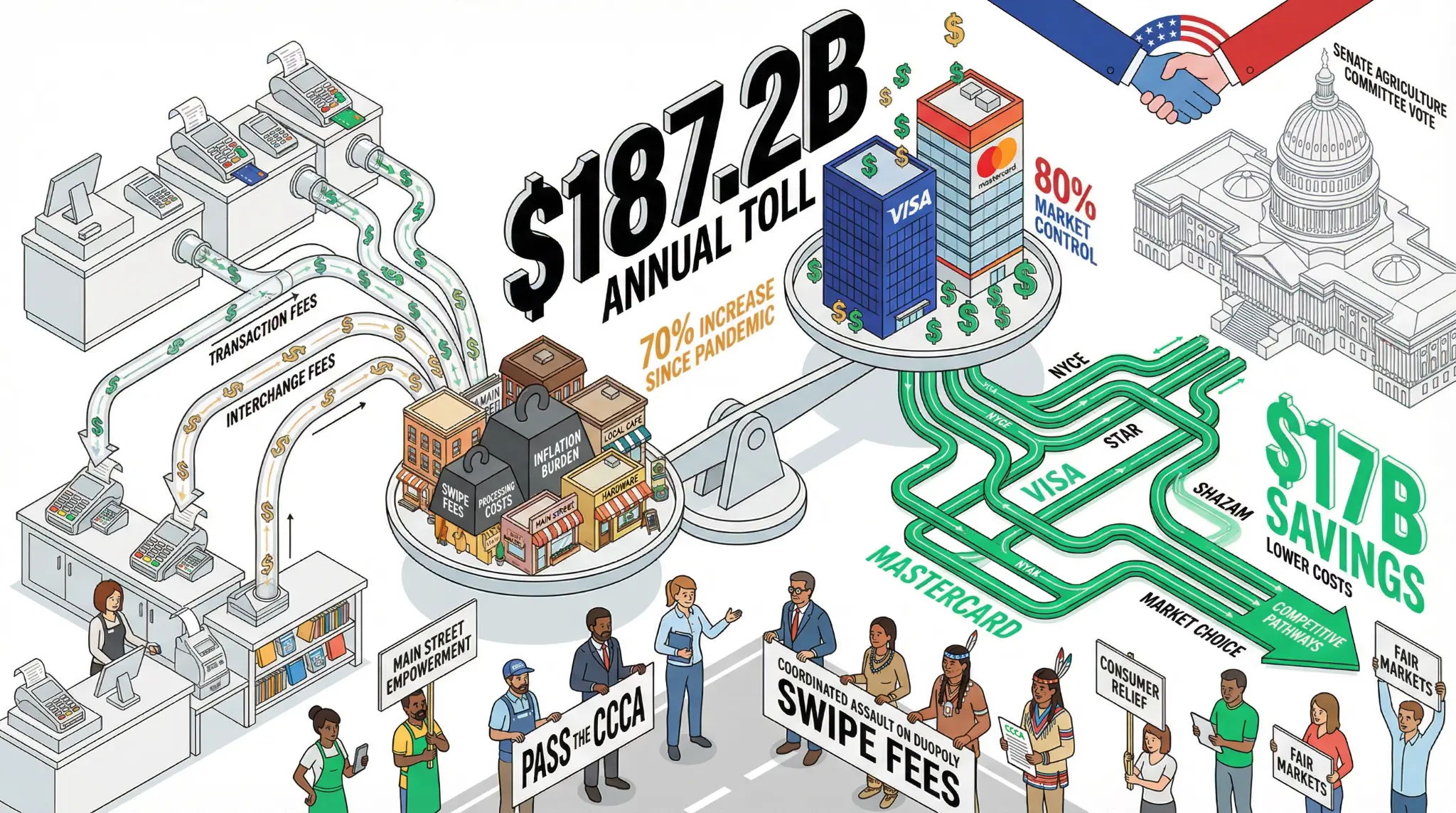

Merchants Coalition Launches Assault on Credit Card Swipe Fees: $187.2B Annual Toll Faces Congressional Challenge

January 26, 2026 - In a coordinated legislative push that has the potential to fundamentally reshape the credit card payments industry, the Merchants Payments Coalition and nearly 350 merchant trade associations have urged the Senate Agriculture Committee to include the Credit Card Competition Act (CCCA) as part of cryptocurrency marketplace structure legislation [1][2]. The move comes just two we