Malaysia Digital Payments Market Reaches $291.79 Billion: Asia's E-Wallet Revolution Accelerates

In a powerful demonstration of how rapidly digital payments are transforming emerging markets, Malaysia's digital payments market is projected to reach $291.79 billion in 2026, driven by explosive growth in e-wallet adoption, Islamic fintech solutions, and super-apps that are fundamentally reshaping how consumers and businesses conduct transactions. With e-wallet penetration at 88% in urban areas and with cross-border QR infrastructure enabling seamless international transactions, Malaysia has become a laboratory for how digital payments will reshape commerce across Asia.

The Malaysian digital payments market is not just growing; it is undergoing a structural transformation. Traditional payment methods are being displaced by digital wallets, mobile money, and fintech solutions at a pace that would have seemed impossible just five years ago. The 88% e-wallet penetration rate in urban areas is not a niche phenomenon; it is mainstream adoption. This means that nearly 9 out of 10 urban consumers in Malaysia are using digital wallets for at least some of their transactions. This is the future of payments, and it is happening now.

The drivers of Malaysia's digital payments growth are diverse and reinforcing. First, e-wallet adoption is accelerating as consumers discover the convenience and efficiency of mobile payments. Second, Islamic fintech solutions are emerging to serve the needs of Malaysia's large Muslim population, creating a new category of financial services. Third, super-apps are consolidating multiple financial services—payments, lending, investing, insurance—into a single platform, increasing user engagement and transaction volume. Fourth, A2A (account-to-account) payment systems are enabling gig economy workers to receive payments instantly, driving adoption among younger, more tech-savvy populations.

The emergence of Islamic fintech solutions is particularly significant. Malaysia has a large Muslim population with specific financial needs and preferences aligned with Islamic law. Traditional fintech solutions were not designed with these needs in mind. Islamic fintech solutions are filling this gap, creating a new category of financial services that is driving adoption among a demographic that might have been underserved by traditional fintech platforms.

The role of super-apps in driving digital payment adoption cannot be overstated. Super-apps like Grab, Gojek, and others have become central to how consumers manage their finances in Southeast Asia. These platforms started as ride-sharing apps, but have evolved to offer payments, lending, investing, and insurance services. By consolidating multiple financial services into a single platform, super-apps increase user engagement and drive transaction volume. They also create network effects that make it difficult for competitors to gain traction.

The 24/7 settlement infrastructure enabled by RENTAS+ (Malaysia's real-time payment system) is also transforming expectations around payment settlement. In traditional banking, settlement can take days. With RENTAS+, settlement is instant, 24/7. This is changing how businesses and consumers expect payments to work. Businesses are expecting faster payouts. Consumers are expecting instant transfers. This shift in expectations is driving adoption of digital payment methods and creating competitive pressure on traditional banking.

For traders, quants, and investors, Malaysia's digital payments market is significant for several reasons. First, it demonstrates that digital payments adoption is accelerating in emerging markets at a pace that exceeds developed markets. Second, it shows that emerging markets are not simply copying the payment models of developed countries; they are innovating and creating new payment models tailored to their specific needs and circumstances. Third, it suggests that the infrastructure providers, fintech companies, and payment processors that serve emerging markets are likely to see explosive growth over the next 5-10 years.

The Malaysian market also has implications for regional and global payment infrastructure. As Malaysia's digital payments market grows, it will create demand for cross-border payment infrastructure that can connect Malaysia to other markets in Southeast Asia and beyond. Companies that can provide this infrastructure—whether through traditional payment networks or through blockchain-based solutions—are likely to see significant growth.

References

Related Articles

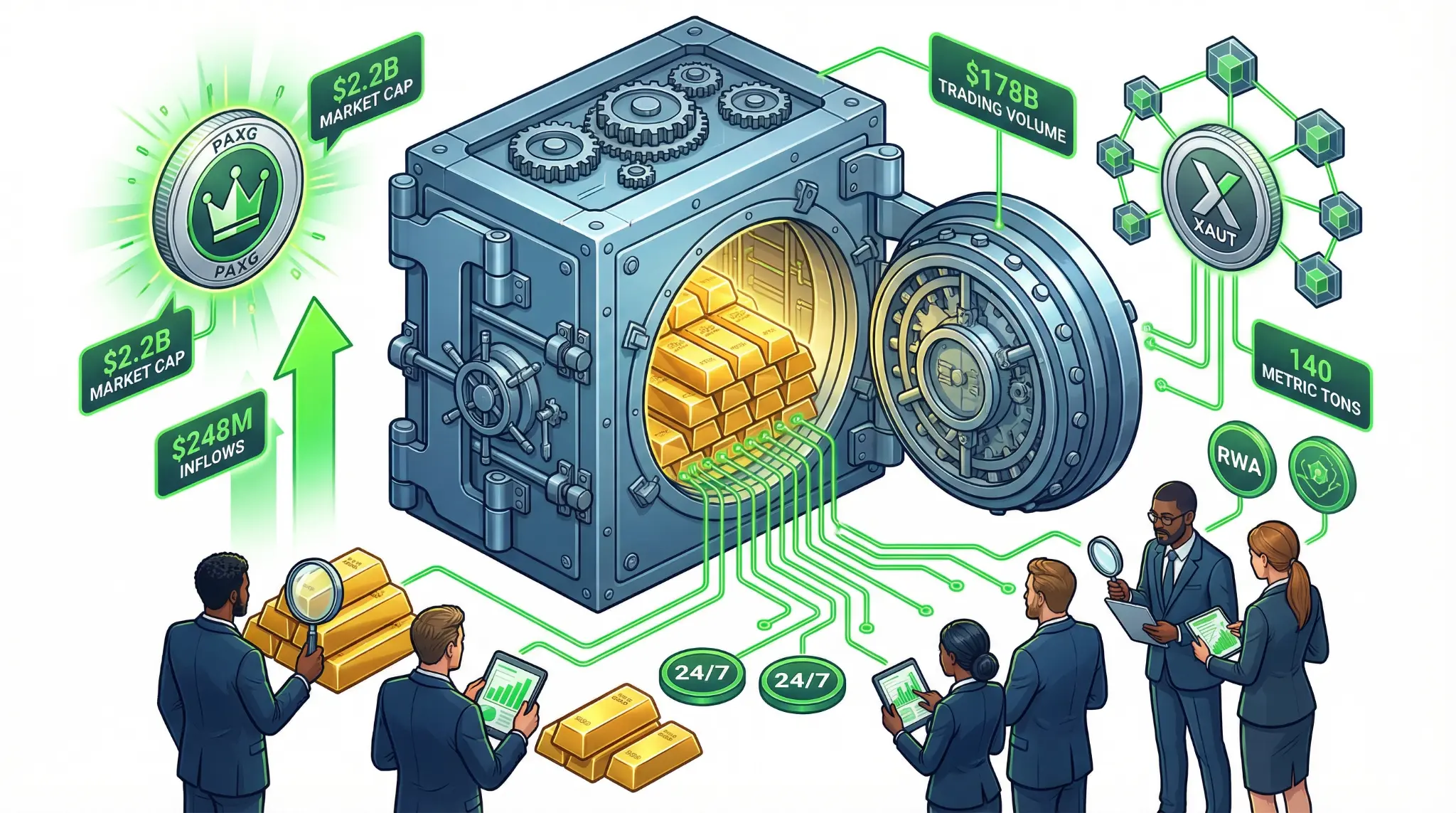

Tokenized Gold Hits $5.8 Billion Market Cap: Paxos and Tether Lead the Real-World Asset Revolution

Tokenized gold market reaches $5.8B market cap with $178B trading volume, led by Paxos Gold ($2.2B) and Tether XAUT (140 metric tons), marking major milestone in real-world asset tokenization.

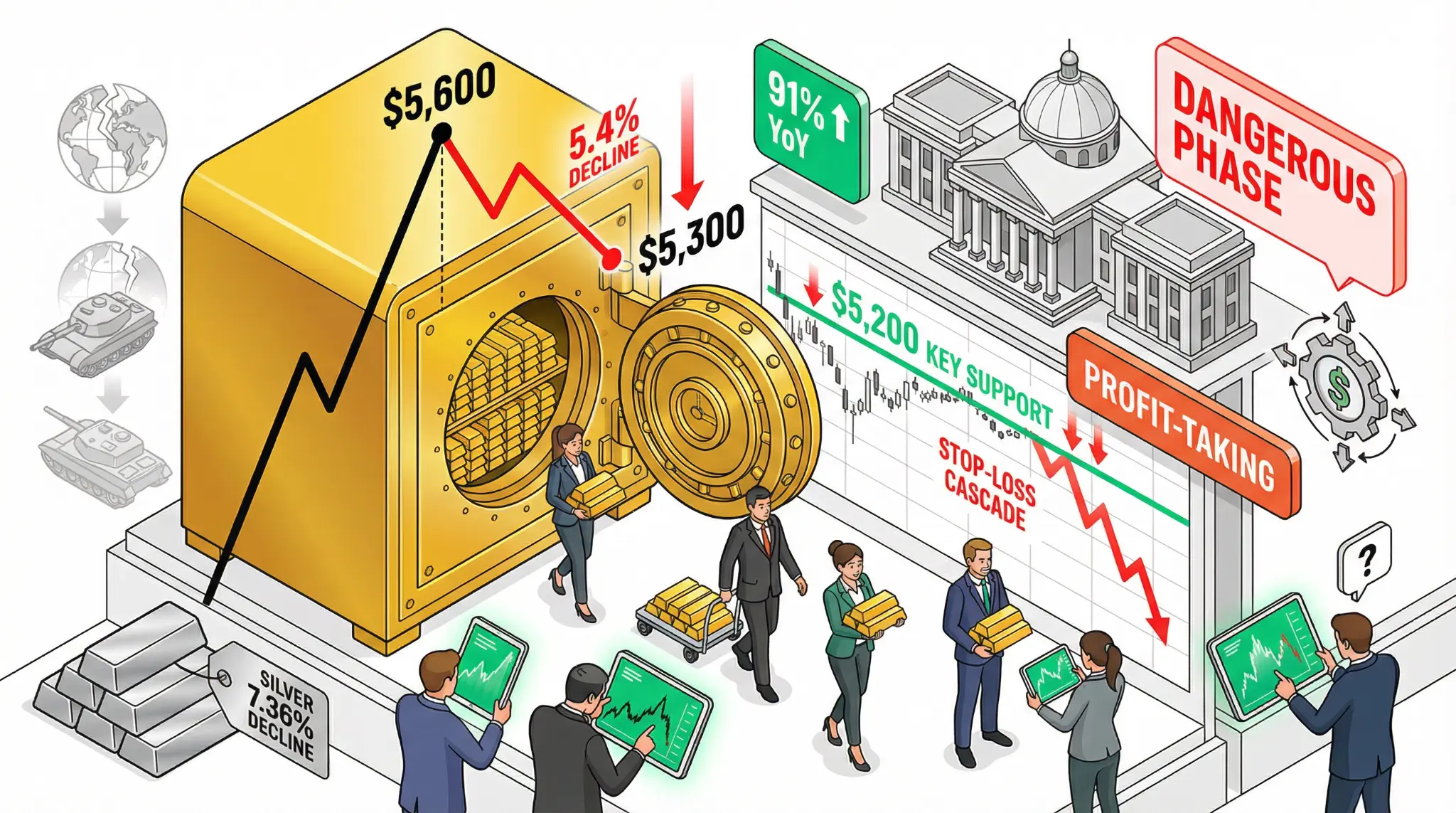

Gold Tumbles from $5,600 Peak to $5,300: Precious Metals Rally Enters 'Dangerous Phase' as Profit-Taking Accelerates

In a sharp reversal that has caught many investors off guard, gold has tumbled from its record peak above $5,600 per ounce to $5,300, a decline of approximately 5.4% in just days. The sharp correction has prompted analysts to warn that the precious metals rally is entering a 'dangerous phase' characterized by profit-taking and potential for further downside. Silver has been hit even harder, sinking 7.36% from its highs above $120 per ounce.

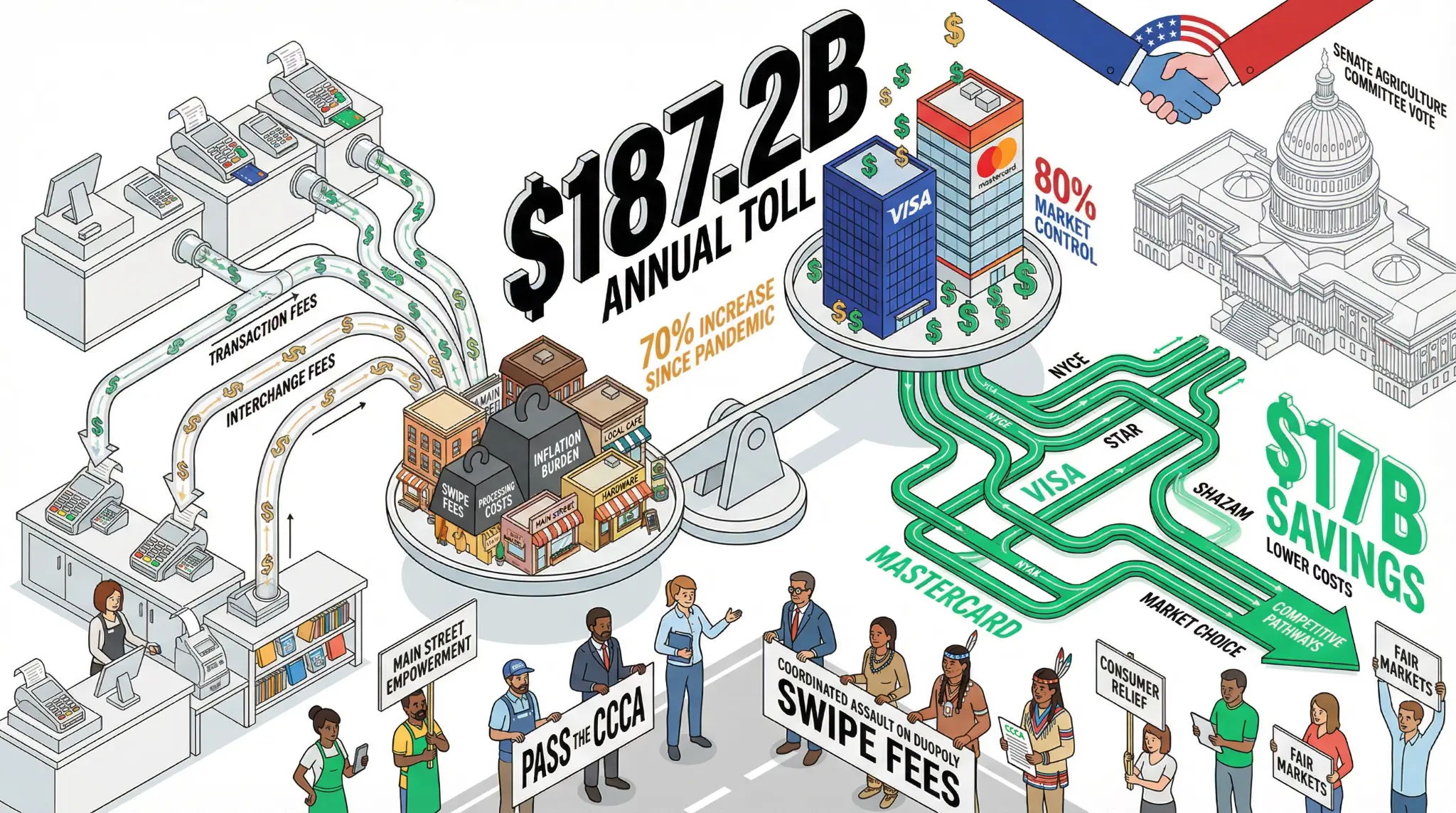

Merchants Coalition Launches Assault on Credit Card Swipe Fees: $187.2B Annual Toll Faces Congressional Challenge

January 26, 2026 - In a coordinated legislative push that has the potential to fundamentally reshape the credit card payments industry, the Merchants Payments Coalition and nearly 350 merchant trade associations have urged the Senate Agriculture Committee to include the Credit Card Competition Act (CCCA) as part of cryptocurrency marketplace structure legislation [1][2]. The move comes just two we