Revolut Applies for US Banking License: European Neobank Seeks to Expand into America's Largest Market

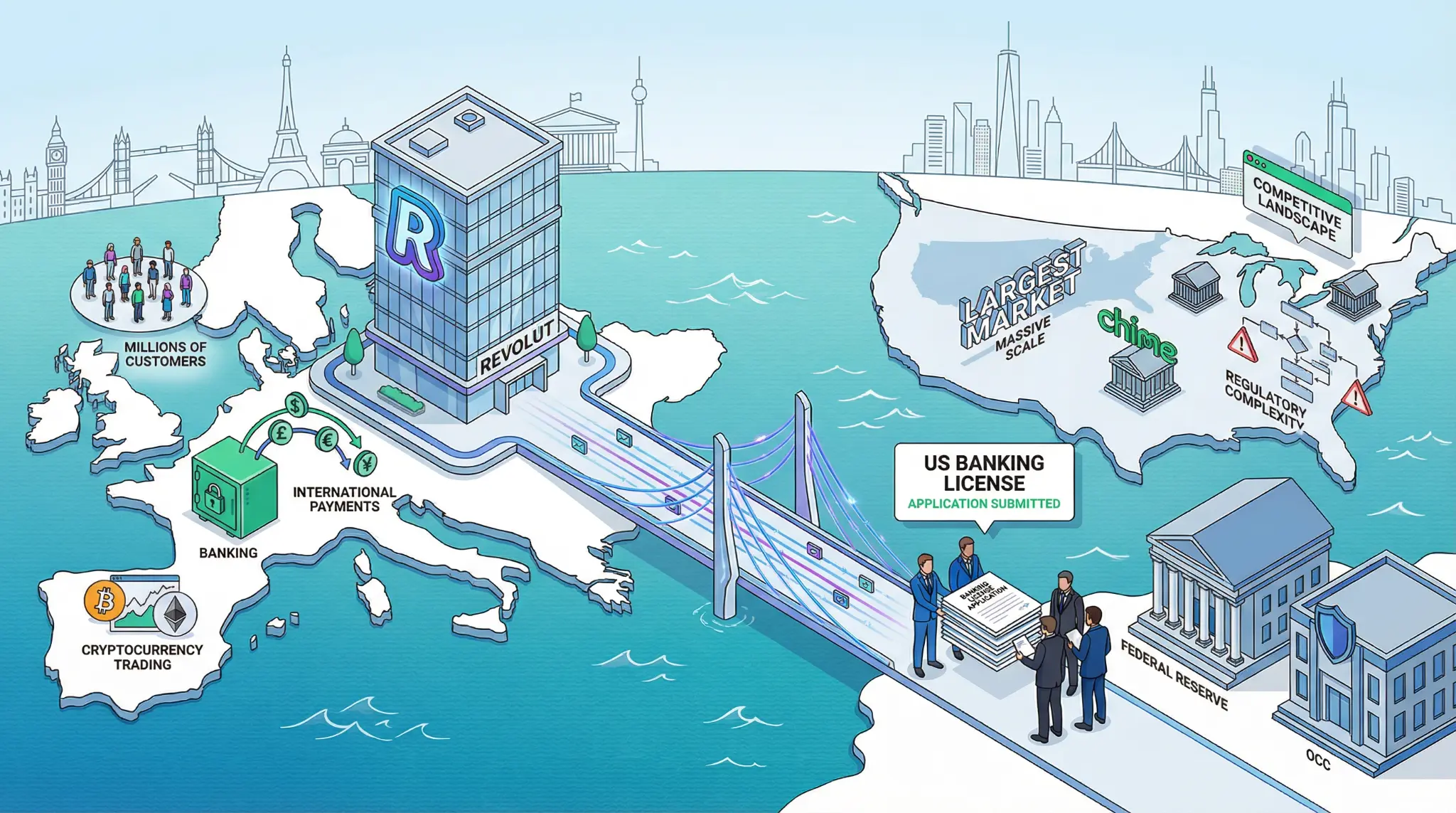

In a strategic move that signals the global ambitions of Europe's leading neobank, Revolut has announced that it is applying for a banking license in the United States, seeking to expand its operations into America's largest and most competitive financial services market. The application represents a significant milestone for Revolut and could accelerate the adoption of neobanking in the United States.

Revolut has been one of Europe's most successful fintech companies, having scaled to serve millions of customers across Europe and Asia. The company has built a reputation for offering low-cost banking services, including international payments, currency exchange, and cryptocurrency trading. By applying for a US banking license, Revolut is seeking to bring its value proposition to American consumers.

"We are excited to announce that Revolut is applying for a banking license in the United States. This represents a significant milestone for our company and reflects our commitment to bringing innovative, low-cost banking services to American consumers," Revolut executives said in a statement.

The significance of Revolut's application for a US banking license cannot be overstated. The United States has been one of the most difficult markets for neobanks to enter, due to the complexity of the regulatory environment and the dominance of established financial institutions. However, the success of neobanks in Europe and Asia has demonstrated that there is significant demand for low-cost, digital-first banking services. Revolut's application suggests that the company believes it can successfully compete in the US market.

US Expansion Details

| Revolut US Expansion Metric | Details | Significance |

|---|---|---|

| Application Status | Applying for banking license | Early stage |

| Target Market | United States | Largest financial market |

| Company Background | European neobank, millions of customers | Proven business model |

| Services Offered | Banking, payments, crypto, FX | Comprehensive offering |

| Competitive Advantage | Low-cost, digital-first | Value proposition |

| Regulatory Complexity | High in US | Key challenge |

| Timeline | Uncertain (regulatory approval) | Multi-year process |

The application also has significant implications for the competitive dynamics of the US banking market. American neobanks like Chime, Revolut's main competitor in the US, have been growing rapidly. However, Revolut's entry into the market could accelerate the adoption of neobanking among American consumers. If Revolut is successful in obtaining a banking license, it could trigger a wave of international neobanks seeking to enter the US market.

The application also has implications for the regulatory environment in the United States. The Federal Reserve and the Office of the Comptroller of the Currency (OCC) have been cautious about granting banking licenses to fintech companies, particularly international companies. However, the success of domestic neobanks has demonstrated that there is demand for this type of service. Revolut's application could force regulators to reconsider their approach to licensing neobanks.

For traders, quants, and investors, Revolut's application for a US banking license is significant for several reasons. First, it demonstrates that international neobanks are seeking to expand into the largest financial market in the world. Second, it suggests that the regulatory environment for neobanks in the US is becoming more favorable. Third, it indicates that competition in the US neobanking market is likely to intensify. Fourth, it could drive significant growth in the adoption of neobanking services among American consumers.

The application also has implications for Revolut's business model. If Revolut is successful in obtaining a US banking license, it could significantly expand the company's addressable market and drive substantial growth in revenues and profitability. However, the regulatory approval process is likely to be lengthy and uncertain, so investors should be cautious about betting on a near-term approval.