Ripple Partners with Riyad Bank's Jeel: Saudi Arabia's Vision 2030 Goes Blockchain

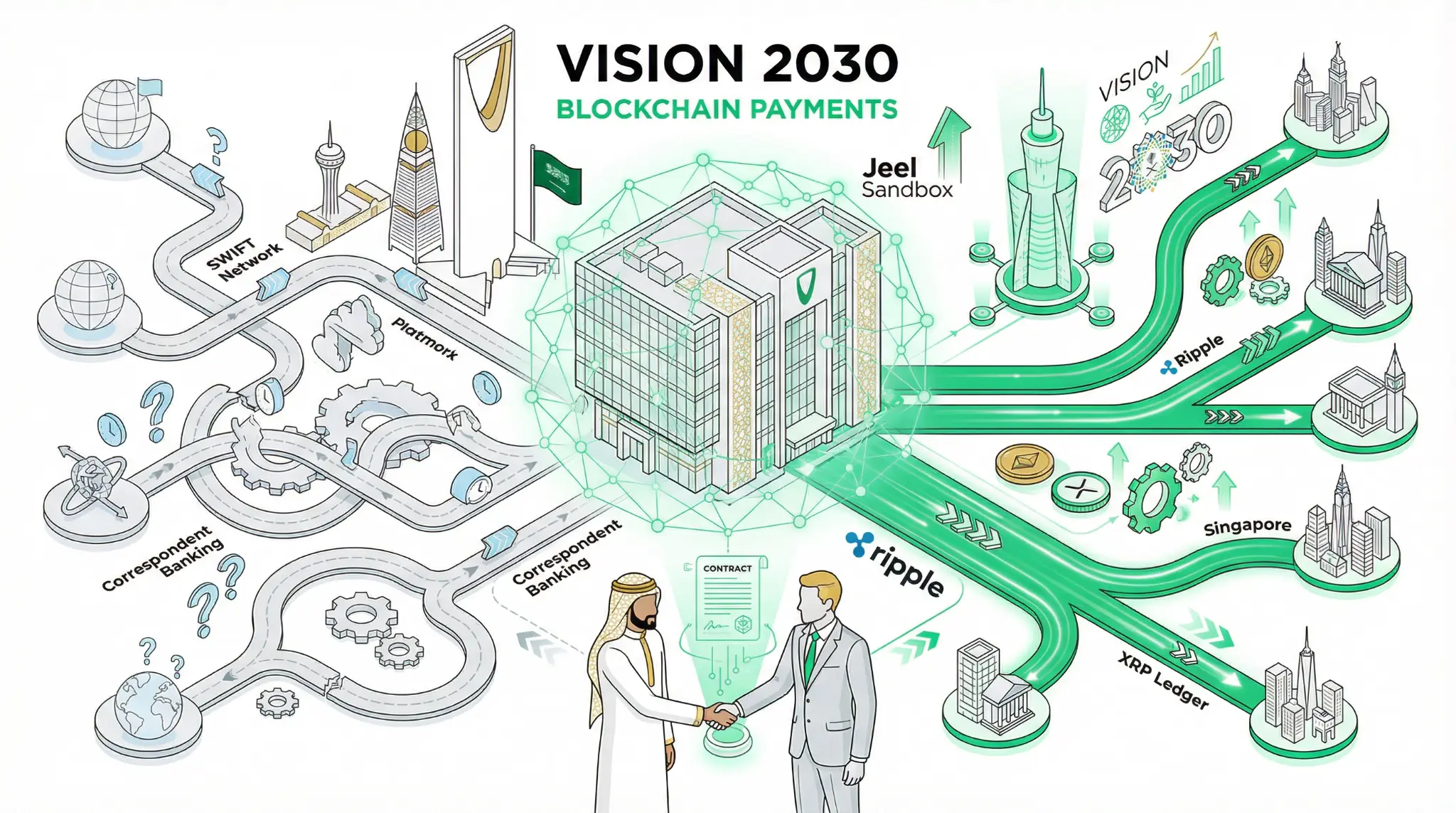

January 26, 2026 - In a strategic partnership that underscores the Middle East's accelerating embrace of blockchain technology, Ripple has signed a memorandum of understanding with Jeel, the innovation subsidiary of Saudi Arabia's Riyad Bank, to explore blockchain applications for cross-border payments, digital asset custody, and tokenization of traditional financial assets [1][2]. The partnership is being conducted within Jeel's regulatory sandbox, ensuring that all experimentation occurs within a compliant framework that aligns with Saudi Arabia's Vision 2030 agenda [1][2][3].

This partnership is not merely symbolic; it represents a fundamental recognition by one of the Middle East's largest financial institutions that blockchain technology is essential to the future of global finance. Riyad Bank is not a startup or a fintech company; it is a major institutional player with deep roots in Saudi Arabia's financial system. By partnering with Ripple, Riyad Bank is signaling to the entire region that blockchain is not a speculative technology for crypto enthusiasts; it is a foundational technology for modernizing financial infrastructure [1].

"This partnership with Ripple reflects our strategy of using the Jeel Sandbox to responsibly explore next-generation financial infrastructure. By combining regulated experimentation with global blockchain expertise, we are building the foundations to evaluate scalable use cases that enhance cross-border payments and digital asset capabilities in line with the Kingdom's long-term digital ambitions," George Harrak, CEO of Jeel, said in a statement [3].

The partnership will focus on three primary areas. First, cross-border payments: Ripple and Jeel will develop blockchain-enabled payment corridors that can improve international remittance experiences and reduce the cost and time required for cross-border settlements. This is particularly significant for the Gulf region, where remittance flows are substantial and where traditional payment infrastructure is expensive and slow. Second, digital asset custody: The partnership will develop secure and transparent digital infrastructure for the custody of digital assets, a critical component of any modern financial system. Third, tokenization: Ripple and Jeel will explore how traditional assets can be converted into digital representations on blockchain networks, a development that could unlock trillions of dollars in new financial markets [1][2][3].

The use of Jeel's regulatory sandbox is particularly noteworthy. The sandbox was established in partnership with FinTech Saudi and is hosted on the Google Cloud platform. It enables developers to deploy simulated interfaces for wallet services into banking-as-a-service platforms, all within a compliant regulatory environment [2]. This approach allows Ripple and Jeel to experiment with blockchain applications without the risk of regulatory backlash or compliance violations.

| Ripple x Riyad Bank Partnership Component | Details | Significance |

|---|---|---|

| Focus Area 1: Cross-Border Payments | Blockchain-enabled payment corridors for remittances. | Reduces cost and time for international settlements. |

| Focus Area 2: Digital Asset Custody | Secure infrastructure for digital asset management. | Essential for institutional adoption. |

| Focus Area 3: Tokenization | Converting traditional assets to digital form. | Unlocks new financial markets. |

| Testing Environment | Jeel Sandbox (Google Cloud-hosted). | Compliant experimentation framework. |

| Vision 2030 Alignment | Part of Saudi Arabia's digital transformation agenda. | Government-backed initiative. |

| Cloud Zone Launch | April 2026 special economic zone. | Tax and regulatory incentives for cloud/digital infrastructure. |

| Saudi Debt Market Projection | $600B outstanding by end of 2026. | Growing capital markets opportunity. |

The broader context for this partnership is Saudi Arabia's ambitious Vision 2030 agenda, which aims to modernize the Kingdom's economy and reduce its dependence on oil revenues. Financial innovation is a key pillar of this agenda. By embracing blockchain technology and partnering with Ripple, Saudi Arabia is positioning itself as a forward-thinking financial hub that is willing to experiment with cutting-edge technologies [2].

The timing of this partnership is also significant. Saudi Arabia is launching a cloud computing special economic zone in April 2026 that will offer tax and regulatory incentives to accelerate cloud adoption and foster local digital infrastructure growth [2]. This suggests that Saudi Arabia is making a coordinated push to build out its digital infrastructure, with blockchain and cloud computing as central components.

The financial opportunity is substantial. Fitch Ratings projects that Saudi Arabia's debt capital market could reach $600 billion outstanding by the end of 2026, indicating ongoing growth in financial innovation and investment attractiveness in the Kingdom [2]. This growing capital market creates demand for the kinds of infrastructure that Ripple and Jeel are developing.

For traders, quants, and investors, the Ripple-Riyad Bank partnership is significant for several reasons. First, it demonstrates that major financial institutions in the Middle East are embracing blockchain technology. Second, it shows that Ripple is successfully positioning itself as the leading enterprise blockchain platform for financial institutions. Third, it indicates that the Middle East is becoming a major hub for blockchain innovation and adoption. Fourth, it suggests that tokenization of traditional assets is moving from theory to practice, with institutional backing.

The partnership also has implications for Ripple's token (XRP) and its business model. As Ripple signs more partnerships with major financial institutions, the value of its enterprise blockchain platform increases. Additionally, as more institutions adopt Ripple's technology for cross-border payments, the demand for XRP as a bridge currency could increase, which could drive appreciation in the token.

References

[1] Ripple Partners with Riyad Bank to Explore Blockchain Applications [2] Ripple signs MOU with Riyad Bank's innovation arm for blockchain solutions [3] Riyad Bank's Jeel Partners With Ripple to Advance Blockchain Payments and Tokenization