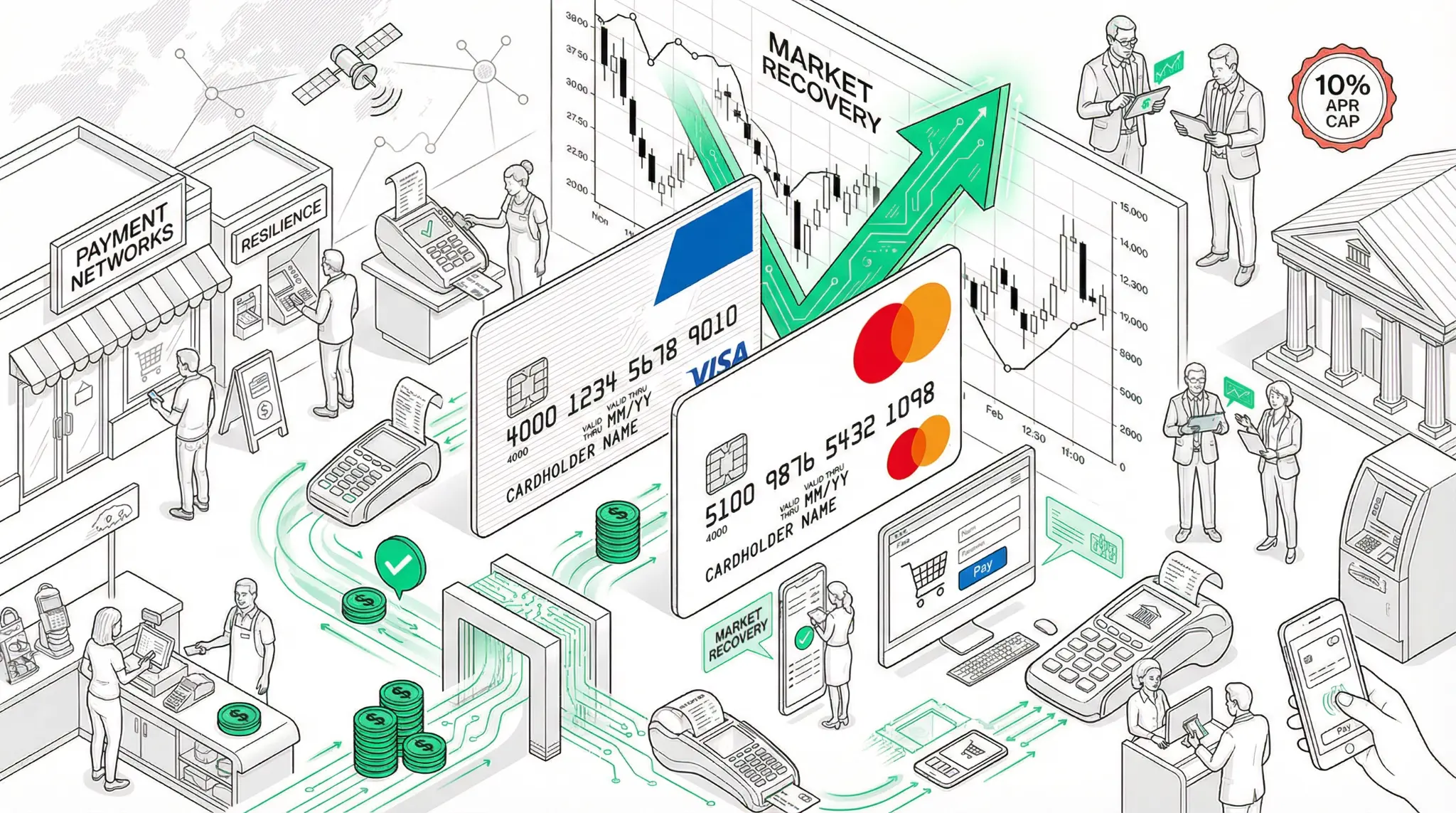

Visa and Mastercard Rebound Despite Trump's 10% APR Cap Proposal: The Toll Road Proves Resilient

In a striking demonstration of the resilience of payment network business models, Visa and Mastercard have rebounded sharply from initial market losses following President Trump's announcement of a proposed 10% emergency cap on credit card interest rates. While the networks initially fell 4.5% and 3.8% respectively on January 13 when the proposal was announced, they have since recovered as investors recognized that the core business model of payment networks is not directly threatened by credit card interest rate caps.

This is a critical insight for understanding the structure of modern financial markets. Visa and Mastercard do not issue credit cards; they operate the networks that process credit card transactions. The interest rates charged by credit card issuers (typically banks) are not directly controlled by Visa and Mastercard. Even if the government caps credit card interest rates at 10%, Visa and Mastercard will continue to earn their transaction fees on every credit card transaction processed. The toll collectors are not threatened by interest rate regulation.

"The initial market reaction to Trump's APR cap proposal was based on a misunderstanding of how payment networks generate revenue," a recent market analysis noted. "Visa and Mastercard's core business is processing transactions and collecting fees, not issuing credit or setting interest rates. Interest rate regulation does not directly impact their revenue model. The market quickly recognized this, which is why the networks have rebounded."

The resilience of Visa and Mastercard's business model in the face of regulatory pressure is a powerful reminder of the structural advantages of payment networks. These networks have become so fundamental to how commerce operates that they are difficult to disrupt or regulate. Even when governments impose restrictions on credit card interest rates, the networks continue to collect their fees. Even when new payment methods emerge, the networks adapt and integrate them into their platforms.

However, the Trump APR cap proposal does have implications for the broader financial system. If credit card interest rates are capped at 10%, credit card issuers will face pressure to reduce credit availability or increase other fees to compensate for lower interest income. This could reduce credit card usage and transaction volumes, which could negatively impact Visa and Mastercard's transaction volumes. Additionally, if credit card usage declines, consumers and merchants might shift to alternative payment methods, including cryptocurrency payments and stablecoins.

This is where the story becomes particularly interesting for traders, quants, and investors focused on cryptocurrency and blockchain. If traditional credit card interest rates are capped, the economics of alternative payment methods become more attractive. Cryptocurrency payments, which offer faster settlement and lower costs than traditional methods, could see accelerated adoption. Stablecoins, which can be used for payments without the complexity of credit card interest rates, could become more appealing to consumers and merchants.

The resilience of Visa and Mastercard in the face of regulatory pressure is also a reminder of the structural advantages of established payment networks. These networks have invested billions of dollars in infrastructure, have millions of merchants and consumers locked into their platforms, and have regulatory relationships that are difficult for competitors to replicate. Even as new payment technologies emerge, the established networks are likely to remain dominant because of these structural advantages.

For traders, quants, and investors, the Visa-Mastercard rebound following the APR cap proposal is significant because it demonstrates that payment networks are resilient to regulatory pressure. However, it also highlights the potential for alternative payment methods to gain market share if traditional payment methods face regulatory headwinds. The companies and tokens that provide alternative payment infrastructure are likely to benefit from any shift in consumer and merchant preferences away from traditional credit cards.

References

[1] Visa and Mastercard Resilience Amid White House War on Credit Fees

Related Articles

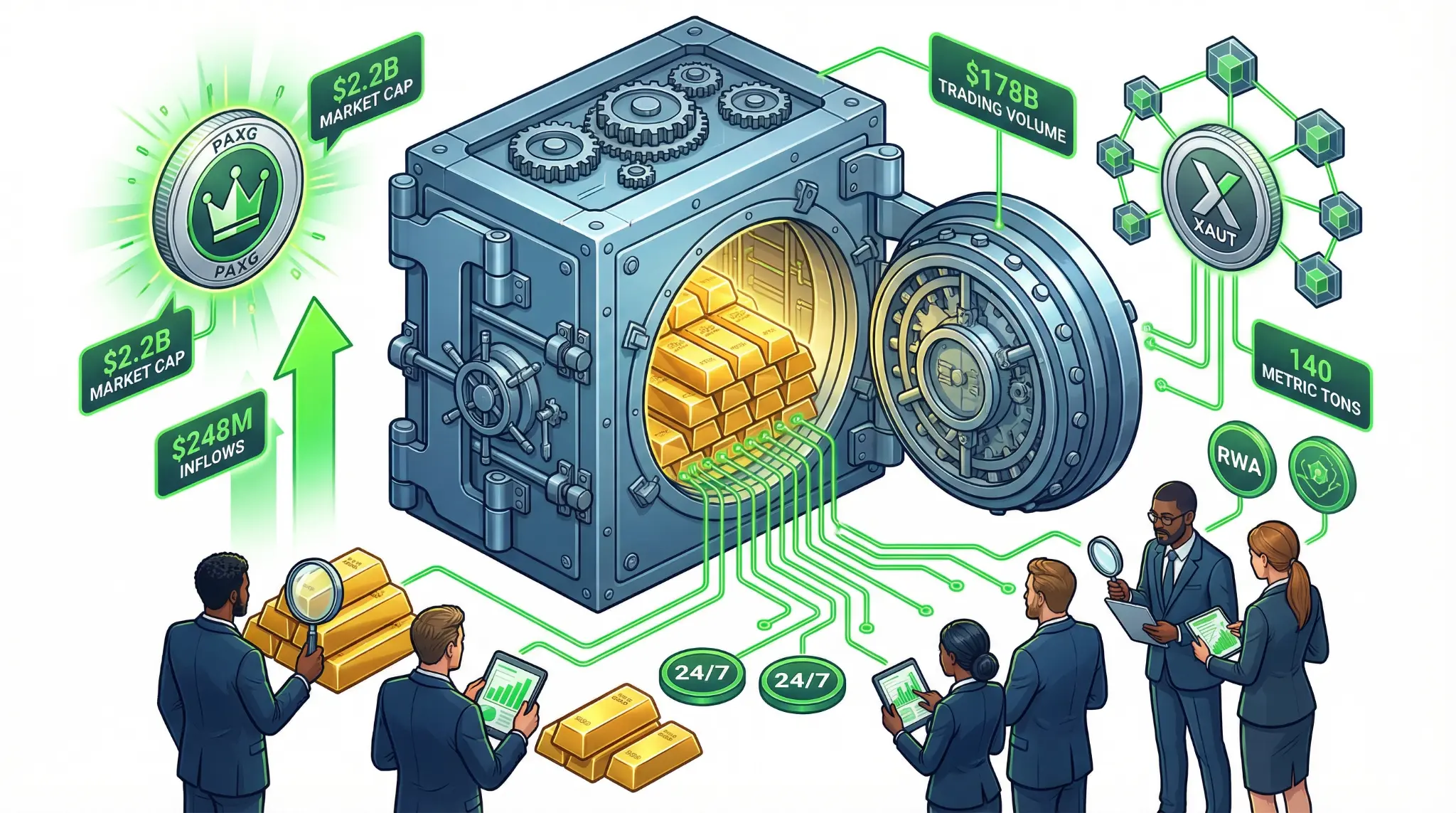

Tokenized Gold Hits $5.8 Billion Market Cap: Paxos and Tether Lead the Real-World Asset Revolution

Tokenized gold market reaches $5.8B market cap with $178B trading volume, led by Paxos Gold ($2.2B) and Tether XAUT (140 metric tons), marking major milestone in real-world asset tokenization.

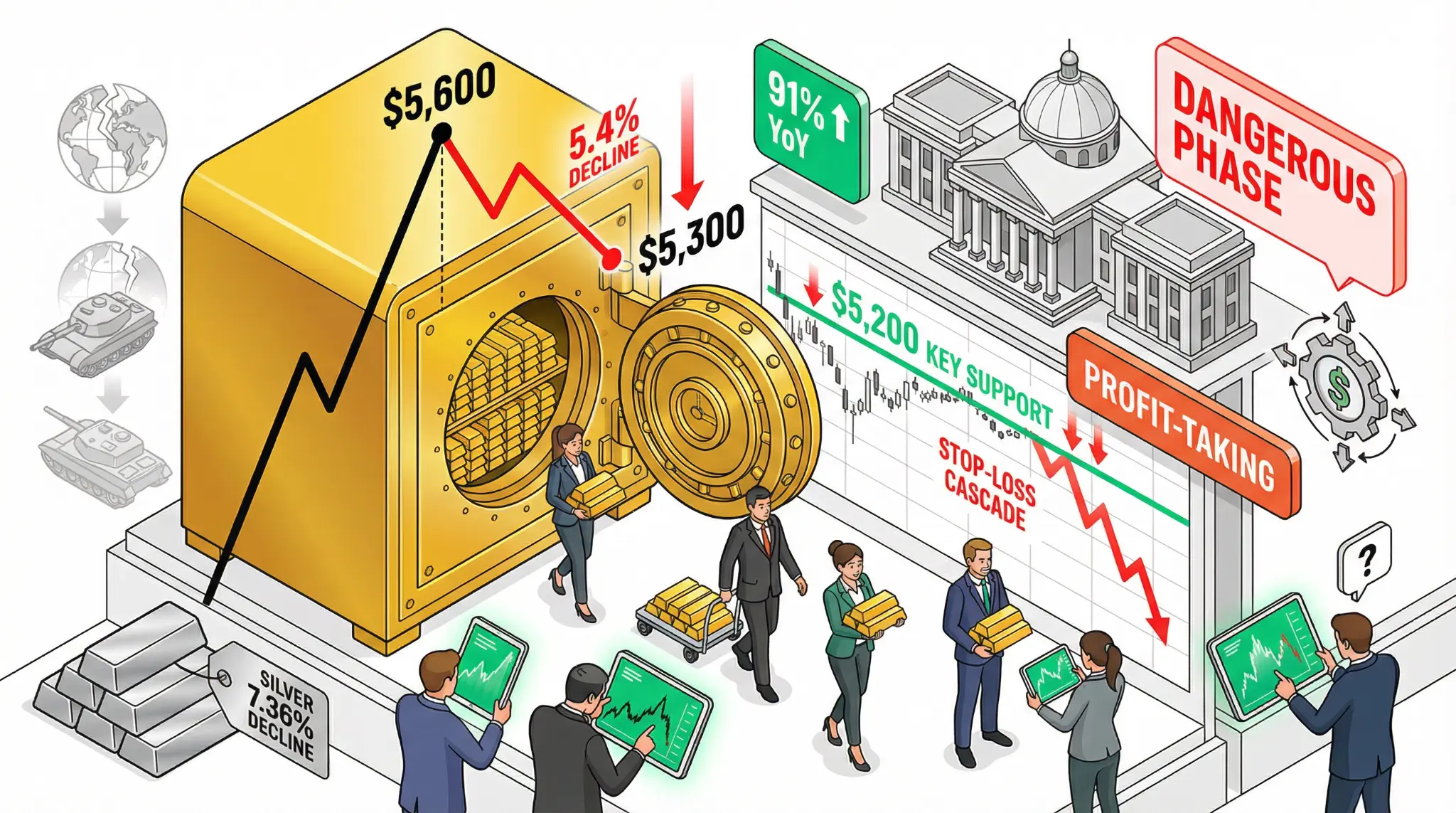

Gold Tumbles from $5,600 Peak to $5,300: Precious Metals Rally Enters 'Dangerous Phase' as Profit-Taking Accelerates

In a sharp reversal that has caught many investors off guard, gold has tumbled from its record peak above $5,600 per ounce to $5,300, a decline of approximately 5.4% in just days. The sharp correction has prompted analysts to warn that the precious metals rally is entering a 'dangerous phase' characterized by profit-taking and potential for further downside. Silver has been hit even harder, sinking 7.36% from its highs above $120 per ounce.

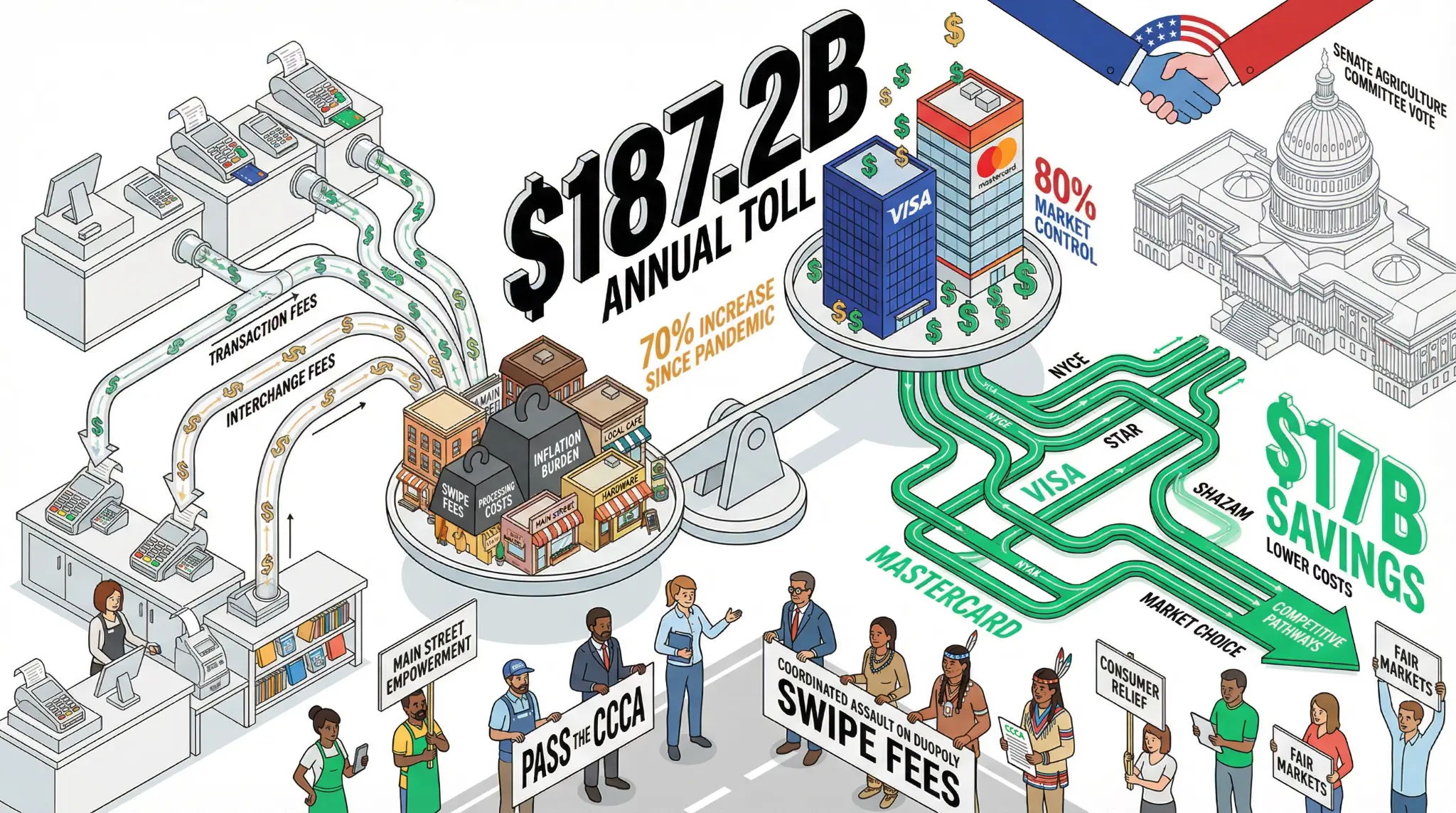

Merchants Coalition Launches Assault on Credit Card Swipe Fees: $187.2B Annual Toll Faces Congressional Challenge

January 26, 2026 - In a coordinated legislative push that has the potential to fundamentally reshape the credit card payments industry, the Merchants Payments Coalition and nearly 350 merchant trade associations have urged the Senate Agriculture Committee to include the Credit Card Competition Act (CCCA) as part of cryptocurrency marketplace structure legislation [1][2]. The move comes just two we