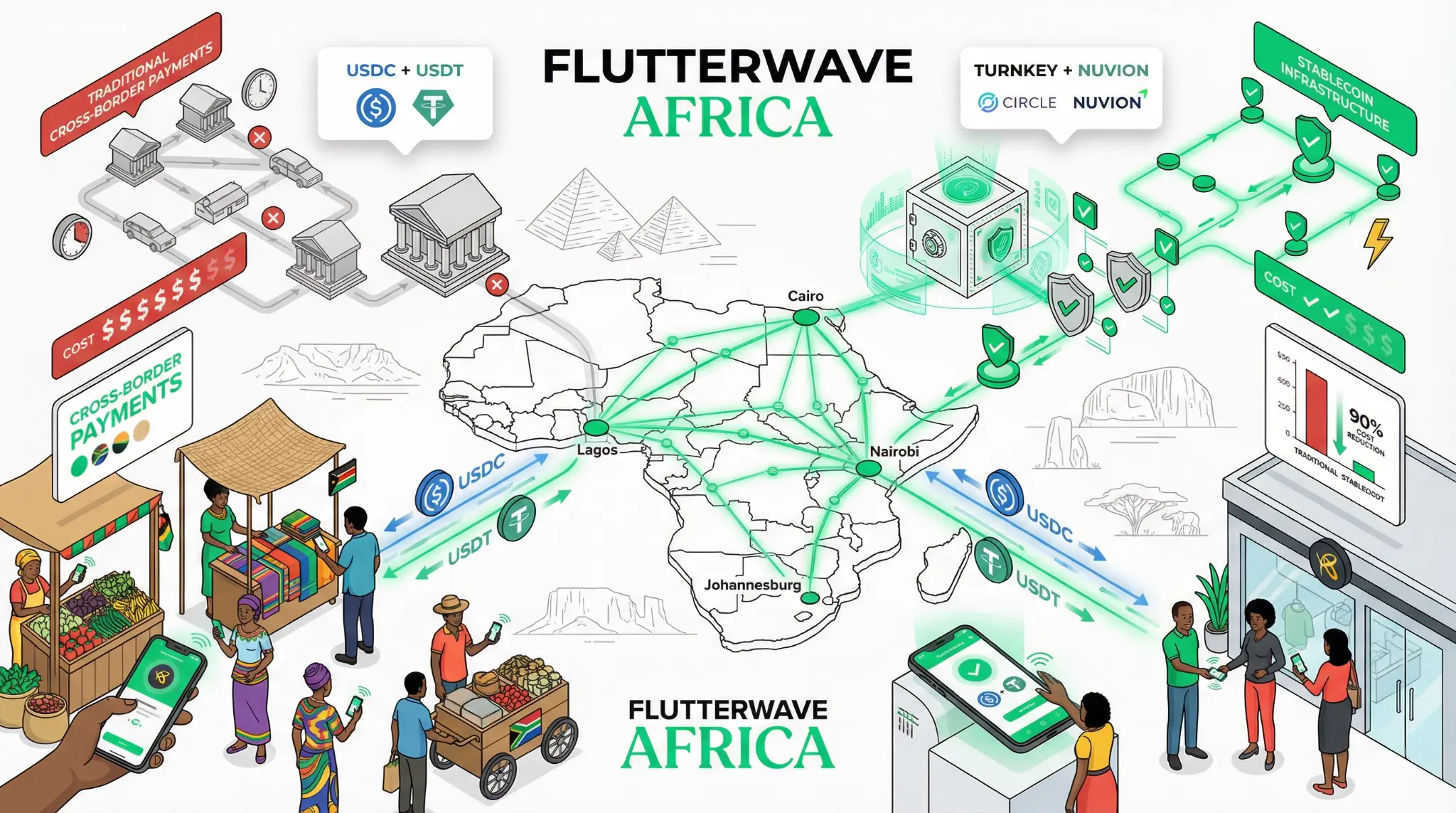

Flutterwave Explores Stablecoin Wallets: Africa's Leading Fintech Launches Secure USDC/USDT Balances for Cross-Border Payments

In a strategic move that brings stablecoin infrastructure to Africa's largest fintech ecosystem, Flutterwave has announced a partnership with Turnkey and Nuvion to launch secure stablecoin balances (USDC and USDT) for merchants and users across Africa. The initiative is designed to dramatically reduce the cost and friction of cross-border payments, which have historically been a major pain point for African businesses and consumers.

Flutterwave is Africa's leading fintech platform, processing billions of dollars in payments annually across the continent. By launching stablecoin wallet infrastructure, Flutterwave is enabling its users to hold and transact in stablecoins, which eliminates the volatility and friction associated with traditional cryptocurrency. This is a critical development for Africa, where traditional cross-border payment infrastructure is expensive and slow.

"We are excited to partner with Turnkey and Nuvion to launch secure stablecoin balances for our users. This initiative will enable African merchants and consumers to access fast, low-cost cross-border payments through stablecoins," Flutterwave executives said in a statement.

The significance of Flutterwave's stablecoin wallet initiative cannot be overstated. Africa has been one of the fastest-growing markets for cryptocurrency and fintech, but the lack of practical stablecoin infrastructure has been a barrier to mainstream adoption. By launching stablecoin wallets, Flutterwave is removing this barrier and enabling millions of African users to access the benefits of stablecoins.

Partnership Details

| Flutterwave Stablecoin Initiative Metric | Details | Significance |

|---|---|---|

| Partner 1 | Turnkey (wallet infrastructure) | Technical backbone |

| Partner 2 | Nuvion (compliance) | Regulatory framework |

| Stablecoins Supported | USDC and USDT | Major stablecoins |

| Target Market | African merchants and users | Massive addressable market |

| Use Case | Cross-border payments | High-friction area |

| Cost Reduction | Significant (vs. traditional) | Key value proposition |

| Speed | Near-instant (blockchain) | Competitive advantage |

The partnership also has significant implications for the competitive dynamics of the African fintech market. Flutterwave faces competition from other fintech platforms like Paystack and Interswitch, as well as from traditional banks and payment networks. By launching stablecoin infrastructure, Flutterwave is differentiating itself and offering a product that competitors may not yet have.

The initiative also has implications for the broader adoption of stablecoins in Africa. If Flutterwave's stablecoin wallet is successful, it could accelerate the adoption of stablecoins across the continent. This could drive significant growth in the market capitalization of stablecoins like USDC and USDT.

For traders, quants, and investors, Flutterwave's stablecoin wallet initiative is significant for several reasons. First, it demonstrates that major fintech platforms are integrating stablecoin infrastructure into their core products. Second, it suggests that stablecoins are becoming essential infrastructure for cross-border payments in emerging markets. Third, it indicates that Africa is becoming a major market for stablecoin adoption. Fourth, it could drive significant growth in the adoption of stablecoins in emerging markets globally.

The initiative also has implications for specific stablecoins. USDC and USDT are the primary stablecoins being supported by Flutterwave's wallet. If the initiative is successful, it could drive significant growth in the adoption and market capitalization of these stablecoins in Africa.

Related Articles

Tether Launches USA₮: The First Federally Regulated Stablecoin Marks a Watershed Moment for Digital Dollars

Tether launches USA₮, the first federally regulated stablecoin under the GENIUS Act framework, issued by Anchorage Digital Bank with Cantor Fitzgerald custody, marking a watershed moment in stablecoin legitimization.

MEXC and Ether.fi Launch Co-Branded Crypto Card: 4% Cashback Brings Self-Custody to 150M+ Merchants

January 26, 2026 - In a development that signals the maturation of crypto payment infrastructure, MEXC and Ether.fi have launched a co-branded cryptocurrency credit card that enables users to spend their digital assets at over 150 million Visa merchants globally while maintaining full non-custodial control of their assets [1]. The card offers up to 4% cashback on all purchases with no annual fees,