Tether Launches USA₮: The First Federally Regulated Stablecoin Marks a Watershed Moment for Digital Dollars

In a development that signals the final legitimization of stablecoins within the American financial system, Tether has announced the launch of USA₮ (USAT), a federally regulated, dollar-backed stablecoin designed to operate within the GENIUS Act framework [1]. The launch represents a fundamental shift in how the crypto industry interfaces with traditional financial regulation, and it marks the beginning of a new era in which stablecoins are no longer relegated to the periphery of finance but are instead integrated into the core infrastructure of the American financial system [1].

USA₮ is issued by Anchorage Digital Bank, N.A., a federally chartered bank that has been at the forefront of bridging the gap between traditional banking and digital assets. The bank is led by Bo Hines, former Executive Director of the White House Crypto Council, who brings deep expertise in both cryptocurrency and regulatory affairs. This combination of institutional credibility and regulatory expertise is precisely what was needed to bring a federally regulated stablecoin to market [1].

"USA₮ represents a watershed moment for the stablecoin industry. For the first time, we have a federally regulated, dollar-backed stablecoin that operates within a clear regulatory framework. This is not just a product launch; it is a validation of the stablecoin model by the highest levels of the American financial system," Tether executives said in a statement [1].

The significance of USA₮ cannot be overstated. For years, the stablecoin industry has operated in a regulatory gray zone, with issuers like Tether and Circle operating without explicit federal oversight. The launch of USA₮ changes this dynamic fundamentally. By operating within the GENIUS Act framework, USA₮ establishes a clear regulatory precedent that other stablecoin issuers can follow [1].

| USA₮ Launch Details | Specification | Significance |

|---|---|---|

| Launch Date | January 27, 2026 | Official market entry. |

| Issuer | Anchorage Digital Bank, N.A. | Federally chartered bank. |

| Regulation | GENIUS Act compliant | Clear regulatory framework. |

| Custody Partner | Cantor Fitzgerald | Institutional-grade custody. |

| Initial Exchanges | Bybit, Crypto.com, Kraken, OKX, Moonpay | Broad market access. |

| CEO | Bo Hines (White House Crypto Council) | Regulatory expertise. |

| Backing | 1:1 dollar-backed | Full collateralization. |

The choice of Cantor Fitzgerald as the custody partner is particularly significant. Cantor Fitzgerald is one of the largest financial services firms in the United States, with a long history of institutional custody services. By partnering with Cantor Fitzgerald, USA₮ is signaling that it operates at the highest level of institutional-grade custody standards [1].

The launch of USA₮ also has significant implications for the competitive dynamics of the stablecoin market. For years, Tether (USDT) and Circle (USDC) have dominated the stablecoin market, with a combined market capitalization exceeding $100 billion. However, both of these stablecoins have operated without explicit federal regulation. USA₮ changes this dynamic by offering a stablecoin that operates within a clear regulatory framework, which could attract institutional investors and traditional financial institutions that have been hesitant to use unregulated stablecoins [1].

The launch also has implications for the broader adoption of stablecoins in the American financial system. For years, traditional banks and financial institutions have been skeptical of stablecoins, viewing them as a threat to their business models. However, the launch of USA₮ within a clear regulatory framework could change this perception. If USA₮ is successful, it could accelerate the adoption of stablecoins among traditional financial institutions, which could drive significant growth in the overall stablecoin market [1].

For traders, quants, and investors, the launch of USA₮ is significant for several reasons. First, it represents a major validation of the stablecoin model by the highest levels of the American financial system. Second, it suggests that regulatory clarity for stablecoins is emerging, which could reduce regulatory risk for stablecoin issuers and investors. Third, it indicates that the competitive dynamics of the stablecoin market are shifting, with federally regulated stablecoins potentially gaining market share from unregulated competitors. Fourth, it could drive significant growth in the adoption of stablecoins among institutional investors and traditional financial institutions.

The launch also has implications for specific stablecoins. While USA₮ is a new entrant to the market, it will compete directly with USDT and USDC. If USA₮ gains significant market share, it could pressure the valuations and market shares of existing stablecoins. However, the large installed bases of USDT and USDC, combined with their deep liquidity, suggest that they will remain dominant in the stablecoin market for the foreseeable future [1].

References

Related Articles

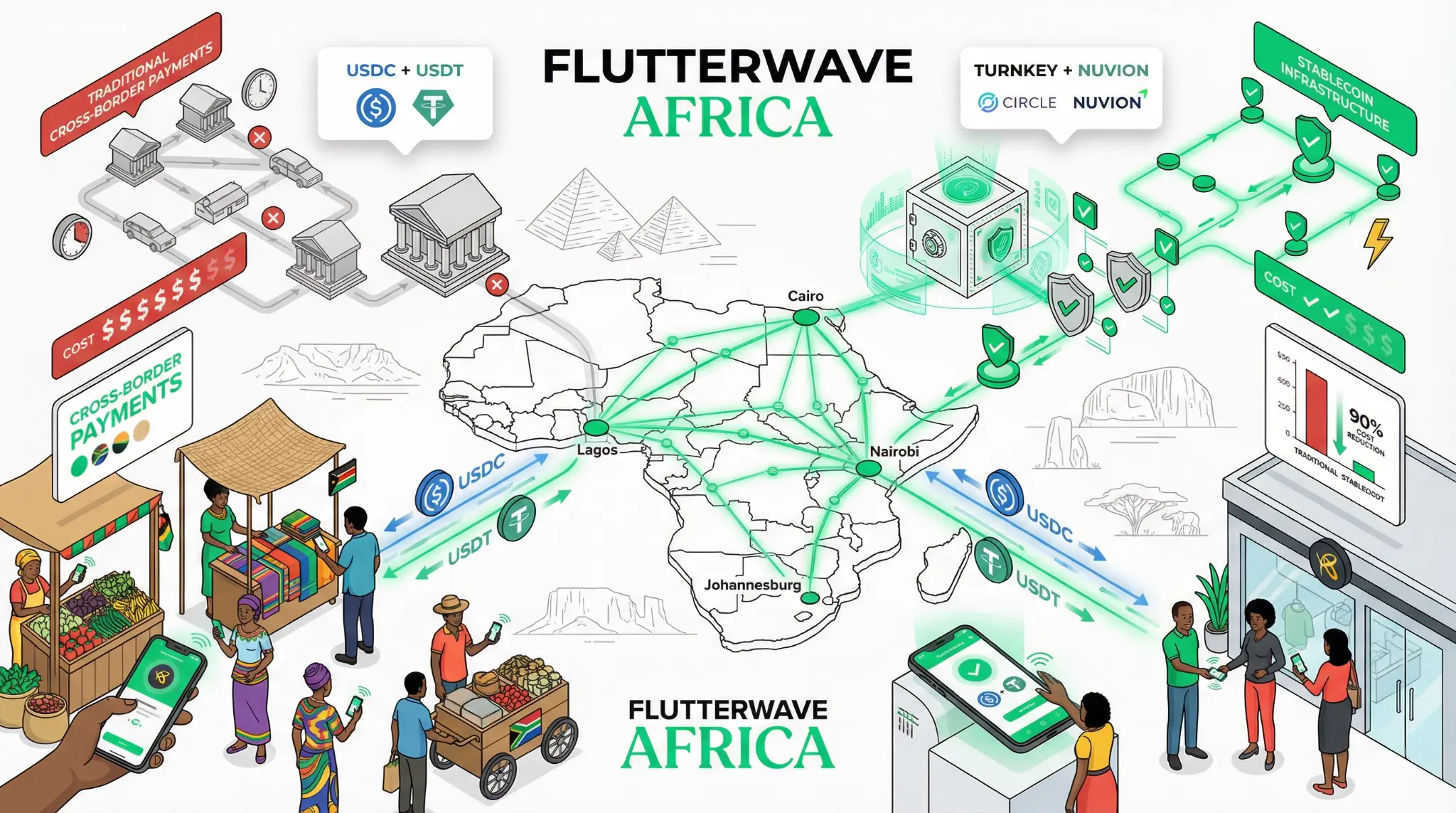

Flutterwave Explores Stablecoin Wallets: Africa's Leading Fintech Launches Secure USDC/USDT Balances for Cross-Border Payments

In a strategic move that brings stablecoin infrastructure to Africa's largest fintech ecosystem, Flutterwave has announced a partnership with Turnkey and Nuvion to launch secure stablecoin balances (USDC and USDT) for merchants and users across Africa. The initiative is designed to dramatically reduce the cost and friction of cross-border payments, which have historically been a major pain point for African businesses and consumers.

MEXC and Ether.fi Launch Co-Branded Crypto Card: 4% Cashback Brings Self-Custody to 150M+ Merchants

January 26, 2026 - In a development that signals the maturation of crypto payment infrastructure, MEXC and Ether.fi have launched a co-branded cryptocurrency credit card that enables users to spend their digital assets at over 150 million Visa merchants globally while maintaining full non-custodial control of their assets [1]. The card offers up to 4% cashback on all purchases with no annual fees,