Elliptic Releases Comprehensive Stablecoin Compliance Playbook: The Regulatory Framework is Finally Here

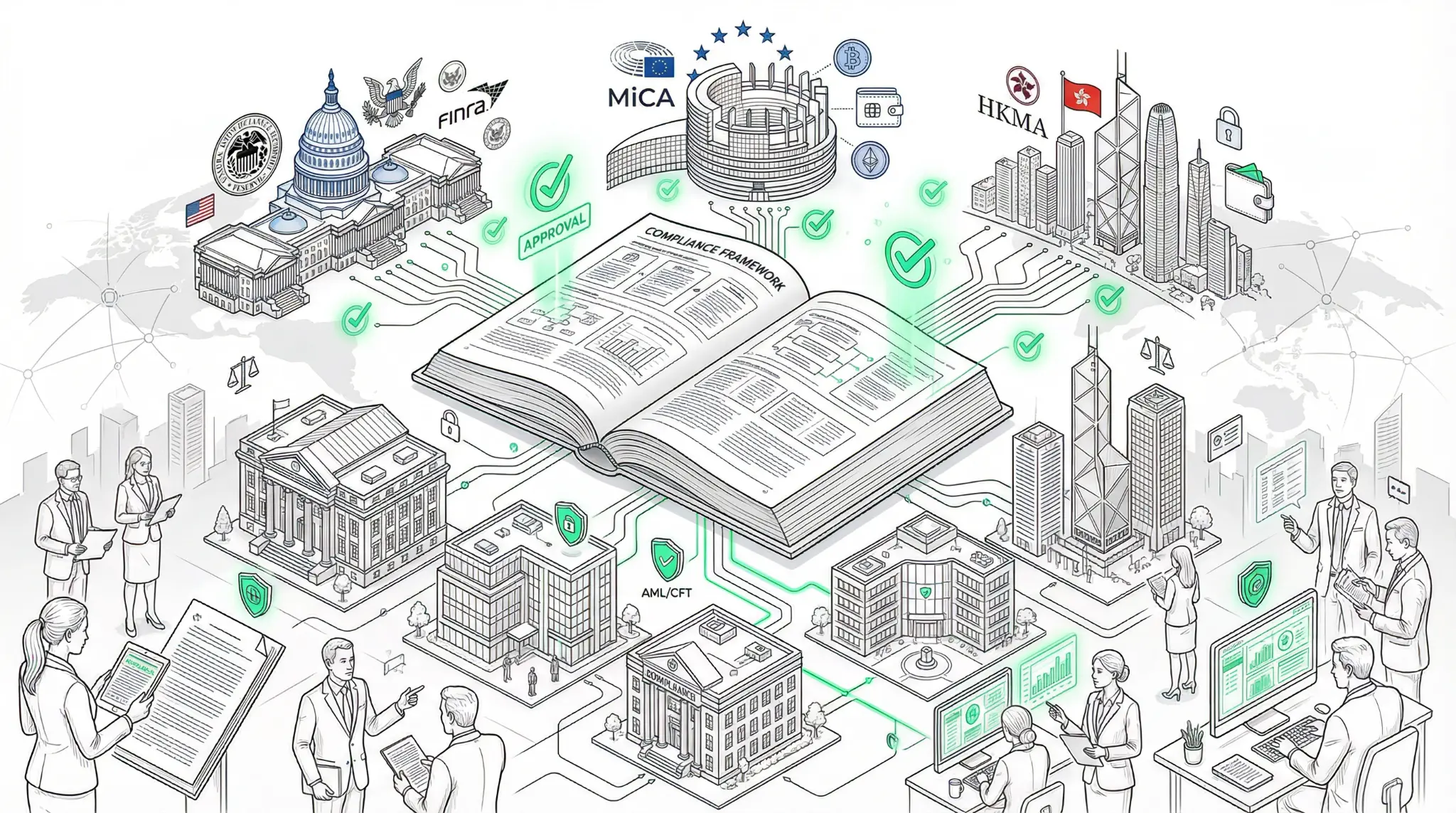

In a development that signals the maturation of the stablecoin ecosystem, Elliptic, a leading blockchain compliance firm, has published a comprehensive compliance playbook for stablecoin issuers and financial institutions. The playbook outlines the regulatory frameworks now in place across the US, EU, and Hong Kong, and provides detailed guidance on anti-money laundering (AML) and counter-financing of terrorism (CFT) measures, as well as sanctions compliance requirements. This is not just another compliance document; it is a roadmap for how traditional finance is integrating stablecoins into their operations.

For years, the stablecoin ecosystem operated in a regulatory gray zone. Issuers and users alike were uncertain about the legal status of stablecoins, the regulatory requirements they must comply with, and the potential penalties for non-compliance. This uncertainty created friction and slowed adoption. Now, with regulatory frameworks in place in major jurisdictions and with detailed compliance guidance available, the barriers to institutional adoption are being systematically dismantled.

"The publication of comprehensive compliance frameworks in the US, EU, and Hong Kong represents a watershed moment for stablecoins," Elliptic's analysis noted. "Major institutions can now confidently integrate stablecoins into their operations, knowing that they have clear regulatory guidance and established best practices to follow. The path to mainstream adoption is now clear."

The regulatory frameworks outlined in Elliptic's playbook cover several critical areas. First, they establish clear definitions of what constitutes a stablecoin and what regulatory requirements apply to different types of stablecoin issuers. Second, they outline AML/CFT requirements, including customer due diligence, transaction monitoring, and suspicious activity reporting. Third, they establish sanctions compliance requirements, ensuring that stablecoin transactions do not facilitate payments to sanctioned individuals or entities. Fourth, they provide guidance on operational resilience, cybersecurity, and consumer protection.

The significance of Elliptic's playbook extends beyond compliance. It signals that major financial institutions are now actively preparing to integrate stablecoins into their operations. Banks, payment processors, and fintech companies are no longer asking whether they should support stablecoins; they are asking how to do so in a compliant manner. This shift in institutional thinking is a powerful indicator that stablecoin adoption is accelerating.

The playbook also has implications for the competitive landscape. Stablecoin issuers that have already invested in compliance infrastructure have a significant advantage over new entrants. The barriers to entry for launching a new stablecoin have risen substantially. This could lead to consolidation in the stablecoin market, with a smaller number of well-capitalized, compliant issuers dominating the market.

For traders, quants, and investors, Elliptic's compliance playbook is significant because it removes a major source of uncertainty about the future of stablecoins. Regulatory clarity is a powerful catalyst for adoption. With clear compliance frameworks in place, institutions can confidently integrate stablecoins into their operations, knowing that they are complying with applicable regulations. This could accelerate the adoption of stablecoins in institutional finance, which could drive significant appreciation in stablecoin-related assets and infrastructure.

The playbook also has implications for the broader adoption of blockchain technology. As stablecoins become a standard part of institutional finance, the infrastructure supporting stablecoins—blockchain networks, custody providers, exchanges—will become increasingly important. The companies and networks that provide this infrastructure are likely to see significant growth and appreciation.

References

[1] Elliptic Releases Comprehensive Stablecoin Compliance Playbook

Related Articles

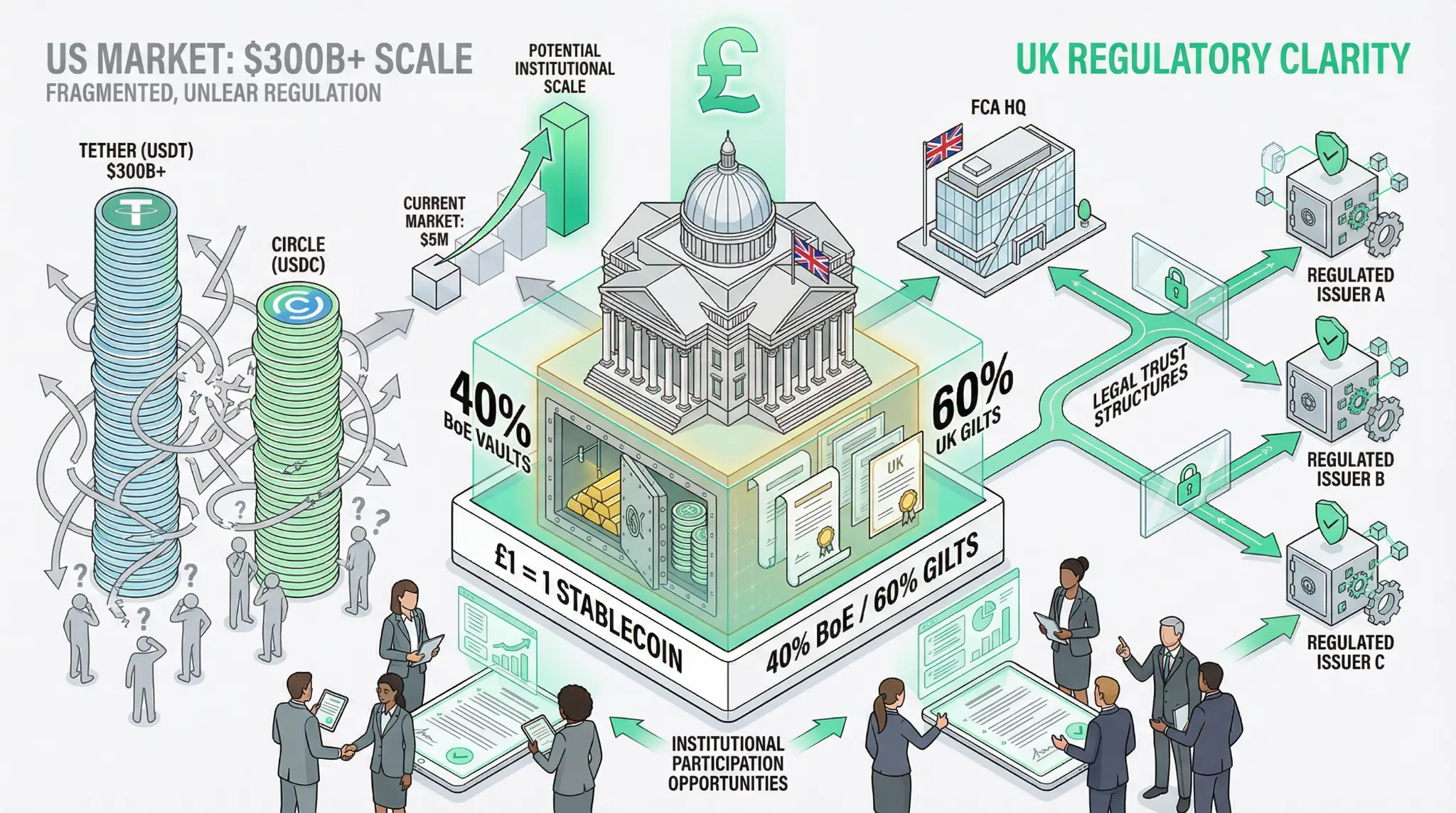

FCA Declares Sterling Stablecoins Top Priority: UK Sets Clear Regulatory Framework While US Remains Fragmented

January 26, 2026 - In a strategic move that positions the United Kingdom as a potential leader in stablecoin regulation, the Financial Conduct Authority (FCA) has declared sterling-backed stablecoins a top priority for 2026, while simultaneously working with the Bank of England to establish a comprehensive regulatory framework [1]. The UK's approach stands in sharp contrast to the fragmented regul

Sumsub and GOE Alliance Sign MoU at Davos: Compliant Crypto Payments Coming to Vietnam

Sumsub and the GOE Alliance have signed a Memorandum of Understanding (MoU) at the World Economic Forum in Davos to support the development of compliant crypto payment infrastructure in Vietnam. This partnership represents a convergence of compliance expertise, regulatory understanding, and market opportunity that could accelerate the adoption of cryptocurrency payments across Southeast Asia.

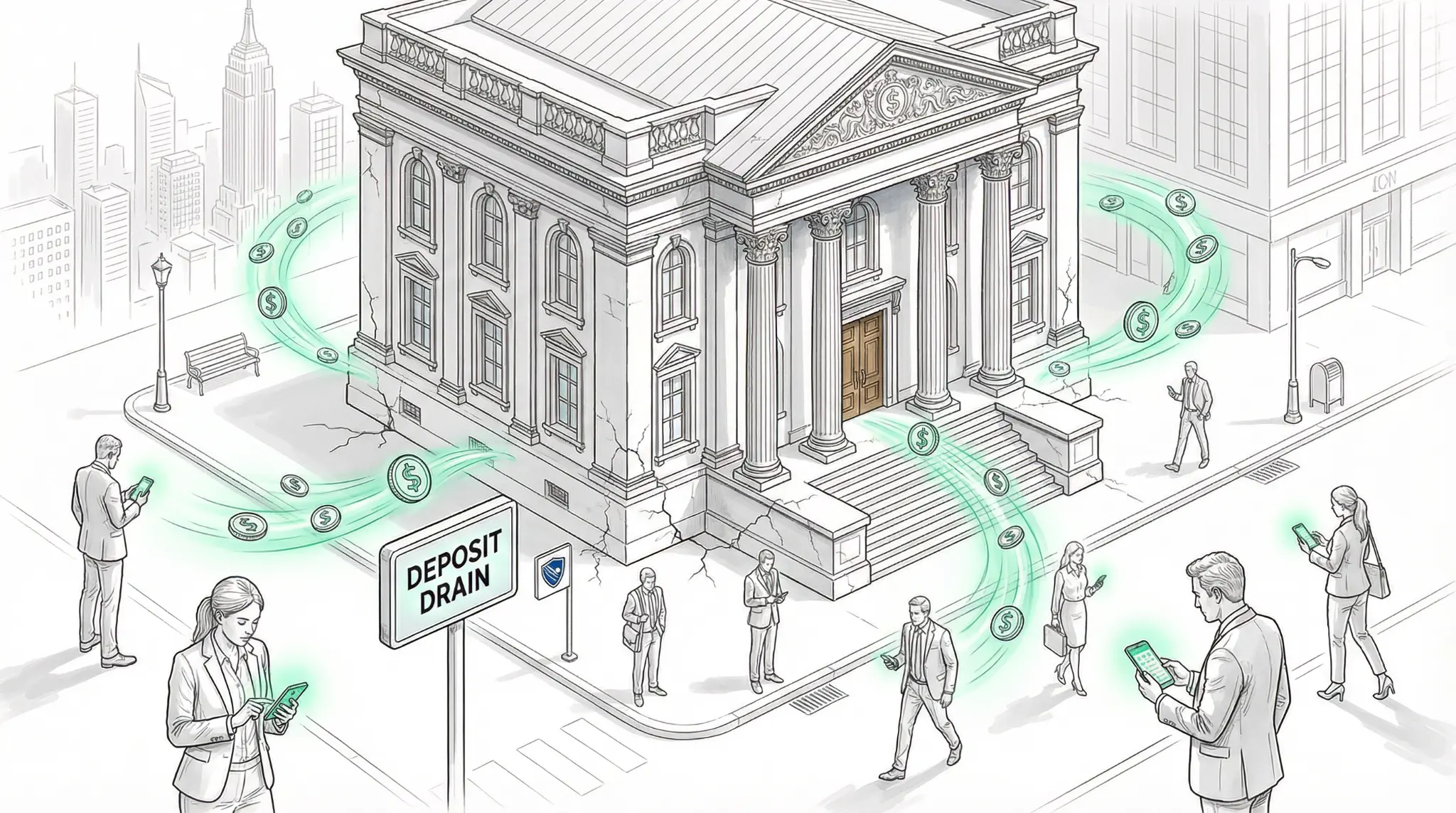

IMF Warns Stablecoins Could Drain Emerging Market Bank Deposits: The Coming Monetary Pressure

The International Monetary Fund has publicly cautioned that dollar-backed stablecoins pose a competitive threat to the monetary frameworks of emerging economies. As stablecoins gain adoption in developing nations, they could systematically drain deposits from traditional banking systems, forcing governments to strengthen their fiscal and monetary policies or risk losing control over their own financial systems.