Sumsub and GOE Alliance Sign MoU at Davos: Compliant Crypto Payments Coming to Vietnam

In a significant development that signals growing institutional support for compliant cryptocurrency payments in Southeast Asia, Sumsub and the GOE Alliance have signed a Memorandum of Understanding (MoU) at the World Economic Forum in Davos to support the development of compliant crypto payment infrastructure in Vietnam. This partnership represents a convergence of compliance expertise, regulatory understanding, and market opportunity that could accelerate the adoption of cryptocurrency payments across Southeast Asia.

The significance of this partnership extends beyond Vietnam. Vietnam is one of the fastest-growing cryptocurrency markets in the world, with millions of users actively trading and using digital assets. However, the regulatory environment has been uncertain and fragmented. By partnering with Sumsub, a leading provider of compliance and identity verification solutions, the GOE Alliance is creating a framework for compliant cryptocurrency payments that could serve as a model for other Southeast Asian countries.

"The Sumsub-GOE Alliance partnership demonstrates that compliance and cryptocurrency payments are not mutually exclusive," a recent analysis noted. "By combining Sumsub's compliance expertise with GOE Alliance's market knowledge and regulatory relationships, the partnership is creating a pathway for cryptocurrency payments to become mainstream in Vietnam. This is a template that other Southeast Asian countries are likely to follow."

Sumsub brings deep expertise in anti-money laundering (AML), know-your-customer (KYC), and compliance verification. The company has worked with hundreds of crypto exchanges, fintech companies, and financial institutions to implement compliant payment and trading infrastructure. By partnering with Sumsub, the GOE Alliance gains access to proven compliance frameworks and best practices that can be adapted to the Vietnamese market.

The partnership also has implications for the broader adoption of cryptocurrency payments in Southeast Asia. Vietnam is one of the largest and most dynamic cryptocurrency markets in the region. If compliant cryptocurrency payment infrastructure can be successfully established in Vietnam, it could serve as a model for other countries in the region. Thailand, Indonesia, Philippines, and Malaysia could all follow similar paths, creating a regional ecosystem of compliant cryptocurrency payments.

The timing of the announcement at Davos is also significant. The World Economic Forum is where global leaders, policymakers, and business executives gather to discuss the future of the global economy. By announcing this partnership at Davos, Sumsub and the GOE Alliance are signaling to the world that cryptocurrency payments are becoming a mainstream financial infrastructure, worthy of discussion at the highest levels of global finance.

For traders, quants, and investors, the Sumsub-GOE Alliance partnership is significant because it demonstrates that regulatory clarity for cryptocurrency payments is emerging. As more countries and regions develop compliant frameworks for cryptocurrency payments, the barriers to adoption will decline. This could accelerate the adoption of stablecoins and cryptocurrency payments globally, which could drive significant appreciation in related assets and infrastructure providers.

The partnership also has implications for the competitive landscape in Southeast Asia. Companies that can provide compliant cryptocurrency payment infrastructure will have a significant advantage in capturing market share. Sumsub, with its compliance expertise, is well-positioned to capture a significant portion of this market. Other compliance and fintech companies are likely to follow with similar partnerships in other Southeast Asian countries.

References

[1] Sumsub and GOE Alliance Sign MoU at WEF 2026 for Compliant Crypto Payments in Vietnam

Related Articles

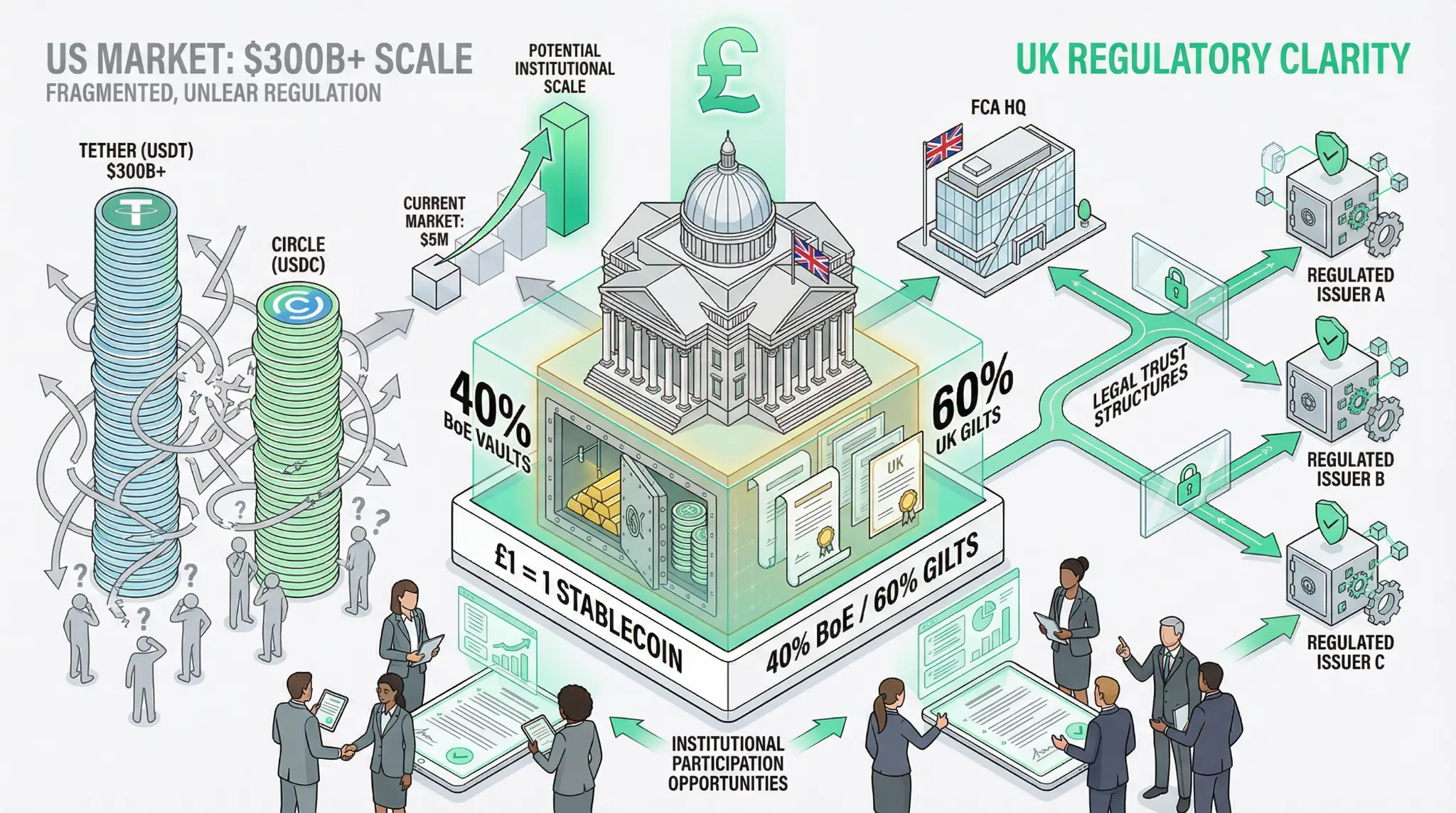

FCA Declares Sterling Stablecoins Top Priority: UK Sets Clear Regulatory Framework While US Remains Fragmented

January 26, 2026 - In a strategic move that positions the United Kingdom as a potential leader in stablecoin regulation, the Financial Conduct Authority (FCA) has declared sterling-backed stablecoins a top priority for 2026, while simultaneously working with the Bank of England to establish a comprehensive regulatory framework [1]. The UK's approach stands in sharp contrast to the fragmented regul

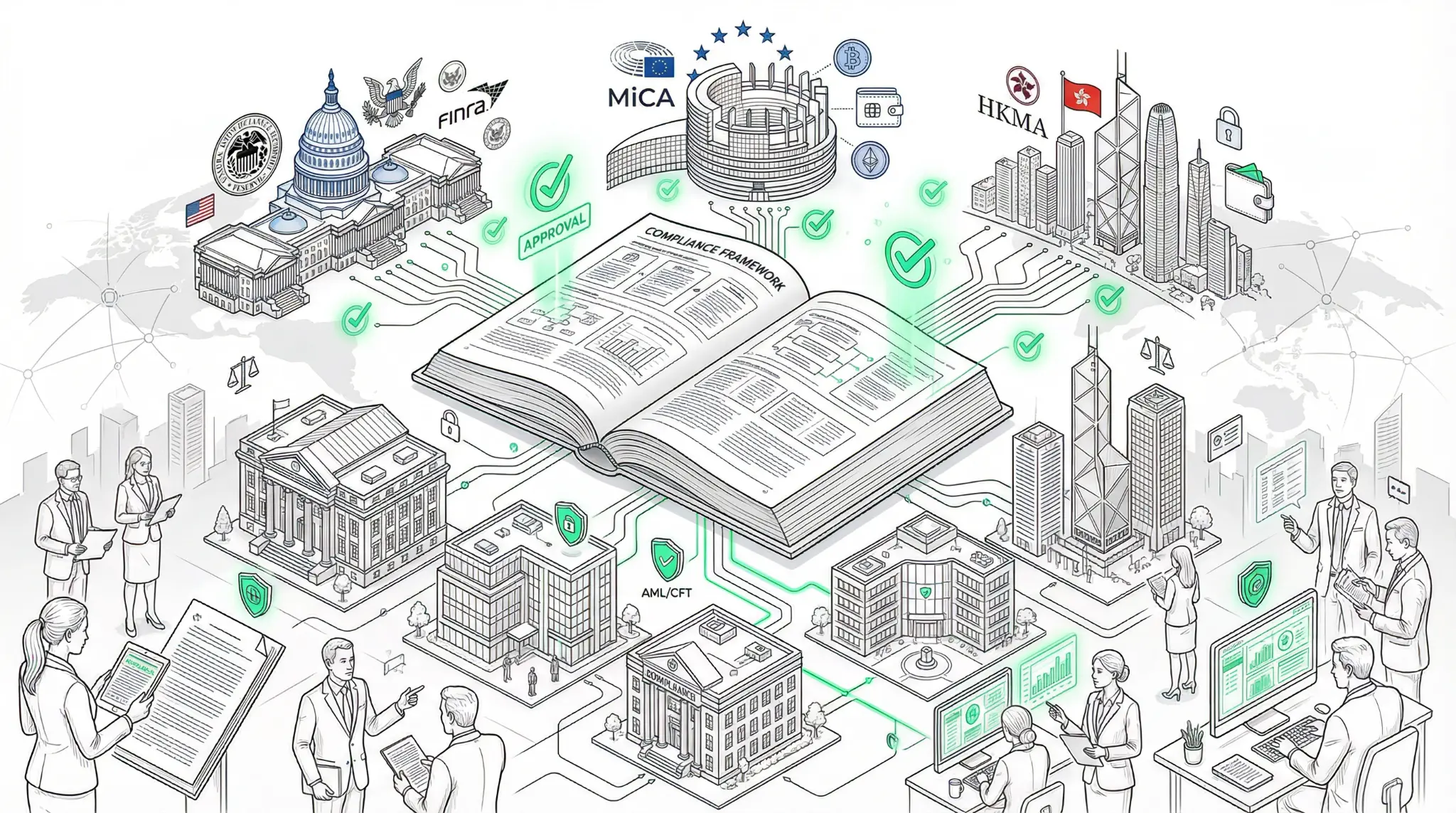

Elliptic Releases Comprehensive Stablecoin Compliance Playbook: The Regulatory Framework is Finally Here

Elliptic, a leading blockchain compliance firm, has published a comprehensive compliance playbook for stablecoin issuers and financial institutions. The playbook outlines the regulatory frameworks now in place across the US, EU, and Hong Kong, and provides detailed guidance on anti-money laundering and counter-financing of terrorism measures, as well as sanctions compliance requirements.

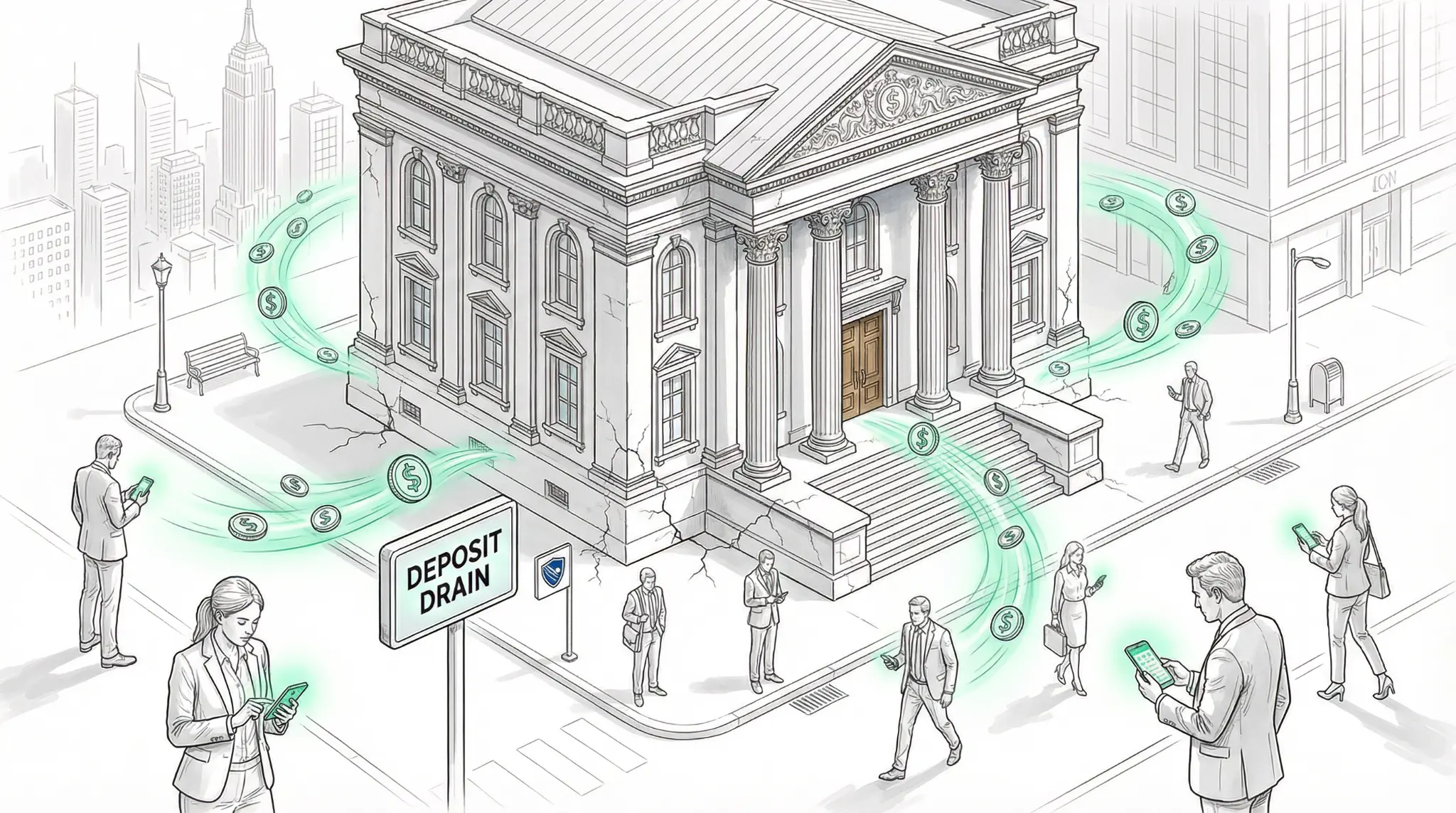

IMF Warns Stablecoins Could Drain Emerging Market Bank Deposits: The Coming Monetary Pressure

The International Monetary Fund has publicly cautioned that dollar-backed stablecoins pose a competitive threat to the monetary frameworks of emerging economies. As stablecoins gain adoption in developing nations, they could systematically drain deposits from traditional banking systems, forcing governments to strengthen their fiscal and monetary policies or risk losing control over their own financial systems.