FCA Declares Sterling Stablecoins Top Priority: UK Sets Clear Regulatory Framework While US Remains Fragmented

January 26, 2026 - In a strategic move that positions the United Kingdom as a potential leader in stablecoin regulation, the Financial Conduct Authority (FCA) has declared sterling-backed stablecoins a top priority for 2026, while simultaneously working with the Bank of England to establish a comprehensive regulatory framework [1]. The UK's approach stands in sharp contrast to the fragmented regulatory landscape in the United States, where stablecoins have scaled rapidly but under unclear accountability and inconsistent oversight [1].

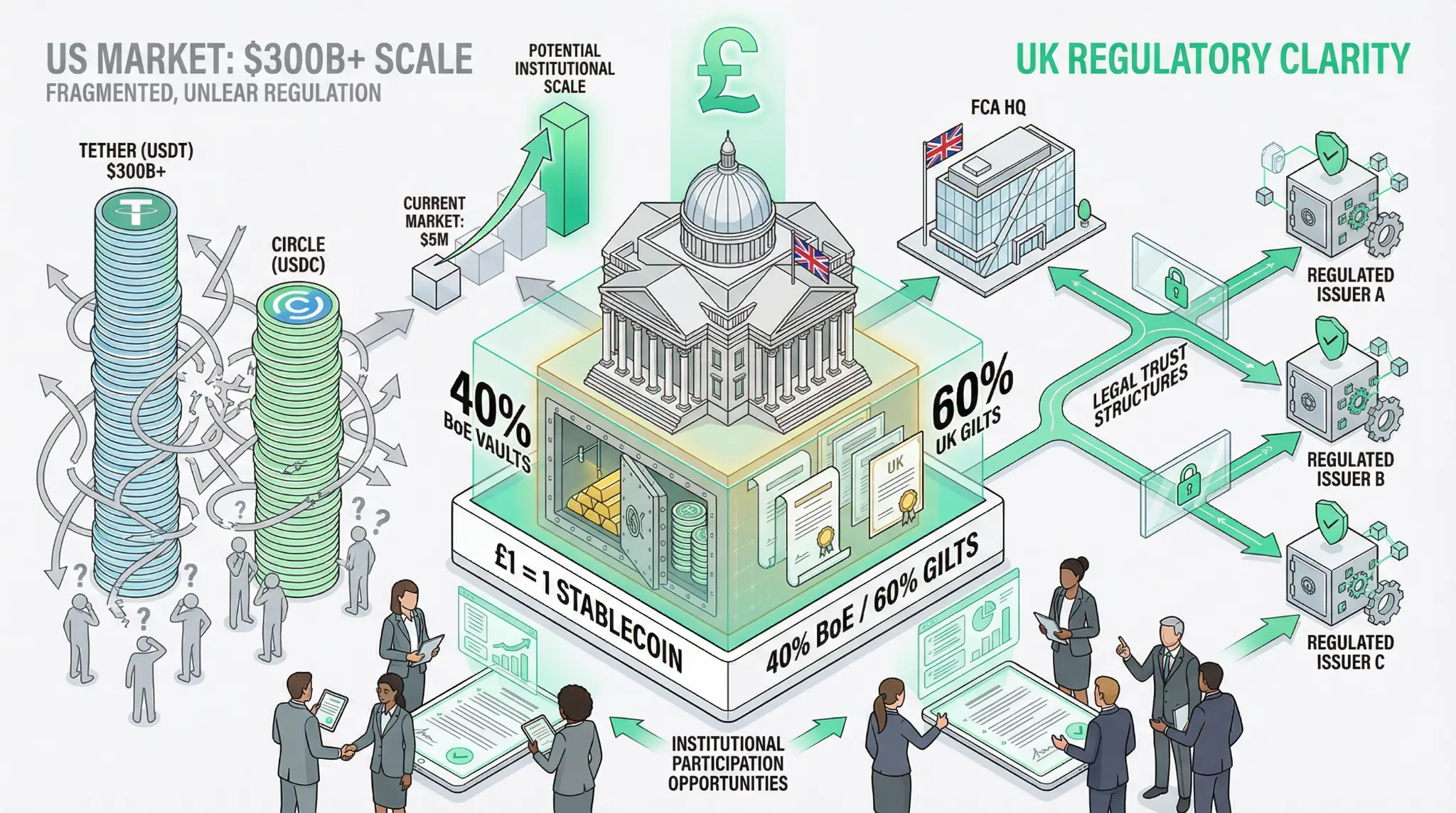

The significance of the FCA's declaration cannot be overstated. The UK stablecoin market is currently worth just over $5 million across three different products—a minuscule market compared to the $300+ billion global stablecoin market dominated by US-based issuers like Tether and Circle [1]. Yet the FCA is treating sterling stablecoins as a priority, which suggests that UK regulators recognize the strategic importance of this market and are determined to establish clear rules that will attract institutional participation and innovation.

"The UK has an opportunity to set clear, upfront rules that allow innovation while embedding safeguards from day one," an industry CEO told DL News. "The expectation is that once the infrastructure layer is clearly regulated, usage by merchants, fintech apps, and consumers will follow." [1]

The FCA and Bank of England have identified five key pillars that will form the foundation of UK stablecoin regulation. First, at least 40% of a stablecoin's backing assets must be held at the central bank, with the remainder in gilts (UK government bonds). This ensures that stablecoin issuers maintain a strong reserve position and that customer funds are protected [1]. Second, customers must be able to redeem one stablecoin for £1 in fiat by the end of a single business day, ensuring liquidity and confidence in the stablecoin's peg [1].

Third, the Bank of England has proposed a controversial cap on the amount of stablecoins an individual can hold, a proposal that has been criticized as a "terrible signal to crypto businesses" [1]. This cap is designed to limit systemic risk, but it could also limit adoption and create friction for users. Fourth, stablecoin providers must operate using a legal trust so that if the company goes bankrupt, customer funds are protected [1]. This is a critical safeguard that ensures that stablecoin issuers cannot use customer funds for their own purposes.

| FCA Sterling Stablecoin Framework | Component | Significance |

|---|---|---|

| Backing Assets | 40% held at Bank of England, remainder in gilts. | Ensures strong reserve position. |

| Redemption Guarantee | 1 stablecoin = £1 fiat by end of business day. | Maintains peg and liquidity. |

| Individual Holdings Cap | Proposed limit on personal holdings. | Limits systemic risk but may restrict adoption. |

| Legal Structure | Must operate via legal trust. | Protects customer funds in bankruptcy. |

| Yield Prohibition | No yield payments to stablecoin holders. | Aligns with US regulatory approach. |

| Current UK Market | $5M across 3 products. | Tiny market with massive growth potential. |

| US Market (Comparison) | $300B+ dominated by Tether and Circle. | Fragmented regulation, rapid scaling. |

Fifth, regulators in the UK are mimicking those in the US by prohibiting stablecoins from paying yield to holders [1]. This is a controversial decision because yield is a powerful incentive for adoption, but it reflects a regulatory preference for treating stablecoins as payment instruments rather than investment vehicles.

The contrast between the UK's approach and the US approach is striking. In the United States, stablecoins like USDT and USDC have scaled to over $300 billion in market capitalization, but they have done so under fragmented oversight and unclear accountability. Different regulators have taken different approaches, and there is no unified federal framework [1]. This fragmentation has allowed stablecoin issuers to move quickly and innovate rapidly, but it has also created regulatory uncertainty and potential systemic risks.

The UK's approach is different. By establishing clear rules upfront, the FCA is attempting to create an environment where institutional investors and major financial institutions feel comfortable participating in the stablecoin market. The theory is that regulatory clarity will drive adoption more effectively than rapid innovation under unclear rules. As one industry CEO noted, "Regulatory clarity that allows banks, payment service providers, and large merchants to participate would drive adoption more effectively than growth in retail markets" [1].

For traders, quants, and investors, the FCA's declaration about sterling stablecoins is significant for several reasons. First, it signals that the UK is positioning itself as a potential leader in stablecoin regulation and innovation. Second, it suggests that sterling-backed stablecoins could become a significant market if the regulatory framework attracts institutional participation. Third, it indicates that the regulatory landscape for stablecoins is becoming clearer globally, which could reduce uncertainty and accelerate adoption. Fourth, it suggests that the fragmented US regulatory approach may eventually give way to more unified frameworks, which could impact the competitive position of US-based stablecoin issuers like Tether and Circle.

The UK's approach also has implications for the broader adoption of blockchain technology. If the FCA successfully establishes a regulatory framework that allows stablecoins to flourish while protecting consumers and maintaining financial stability, it could serve as a model for other jurisdictions. This could accelerate the adoption of stablecoins and blockchain technology globally.

References

[1] Can sterling stablecoins catch digital dollars in 2026? 'This isn't about competing,' says CEO

Related Articles

Sumsub and GOE Alliance Sign MoU at Davos: Compliant Crypto Payments Coming to Vietnam

Sumsub and the GOE Alliance have signed a Memorandum of Understanding (MoU) at the World Economic Forum in Davos to support the development of compliant crypto payment infrastructure in Vietnam. This partnership represents a convergence of compliance expertise, regulatory understanding, and market opportunity that could accelerate the adoption of cryptocurrency payments across Southeast Asia.

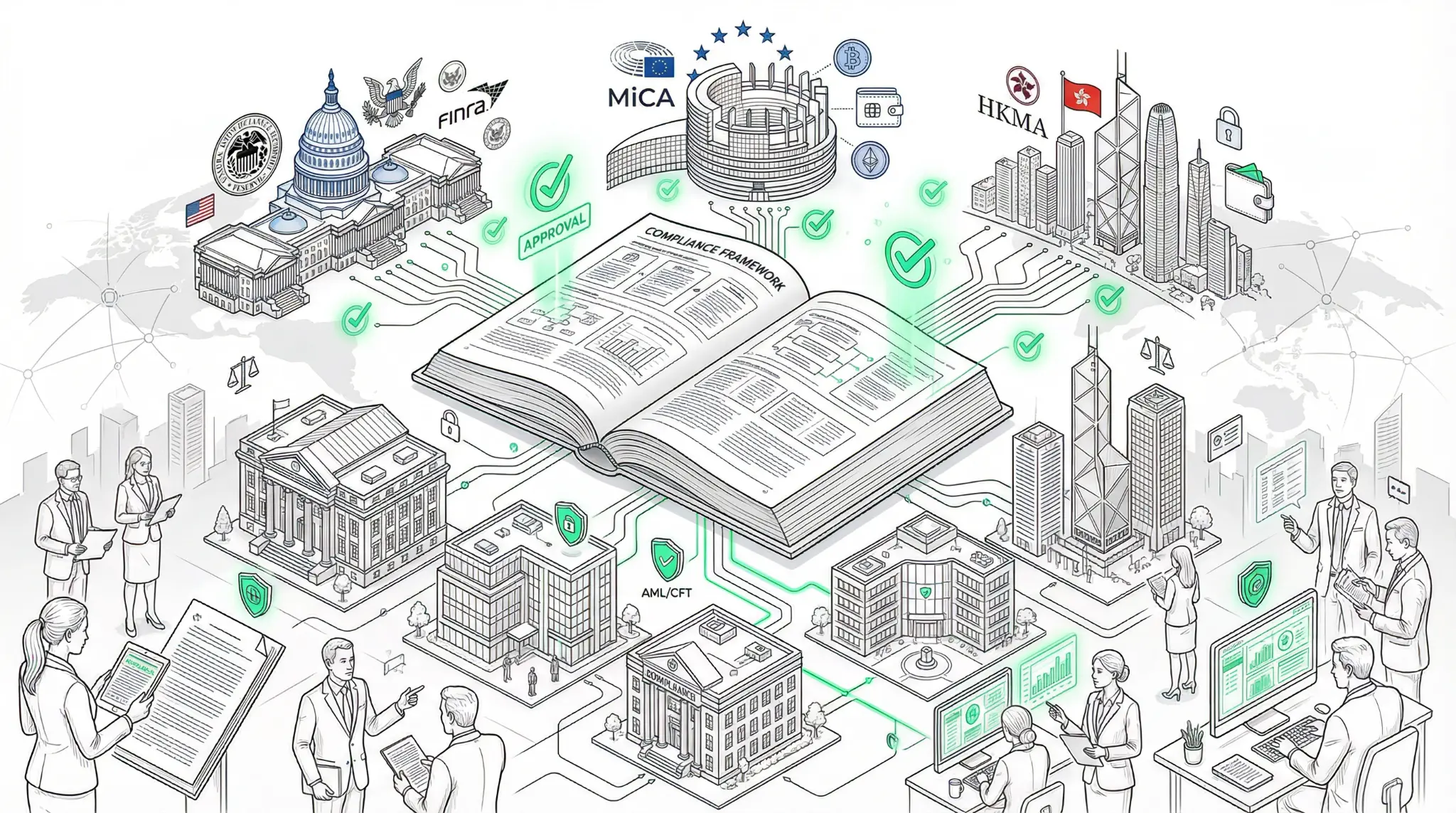

Elliptic Releases Comprehensive Stablecoin Compliance Playbook: The Regulatory Framework is Finally Here

Elliptic, a leading blockchain compliance firm, has published a comprehensive compliance playbook for stablecoin issuers and financial institutions. The playbook outlines the regulatory frameworks now in place across the US, EU, and Hong Kong, and provides detailed guidance on anti-money laundering and counter-financing of terrorism measures, as well as sanctions compliance requirements.

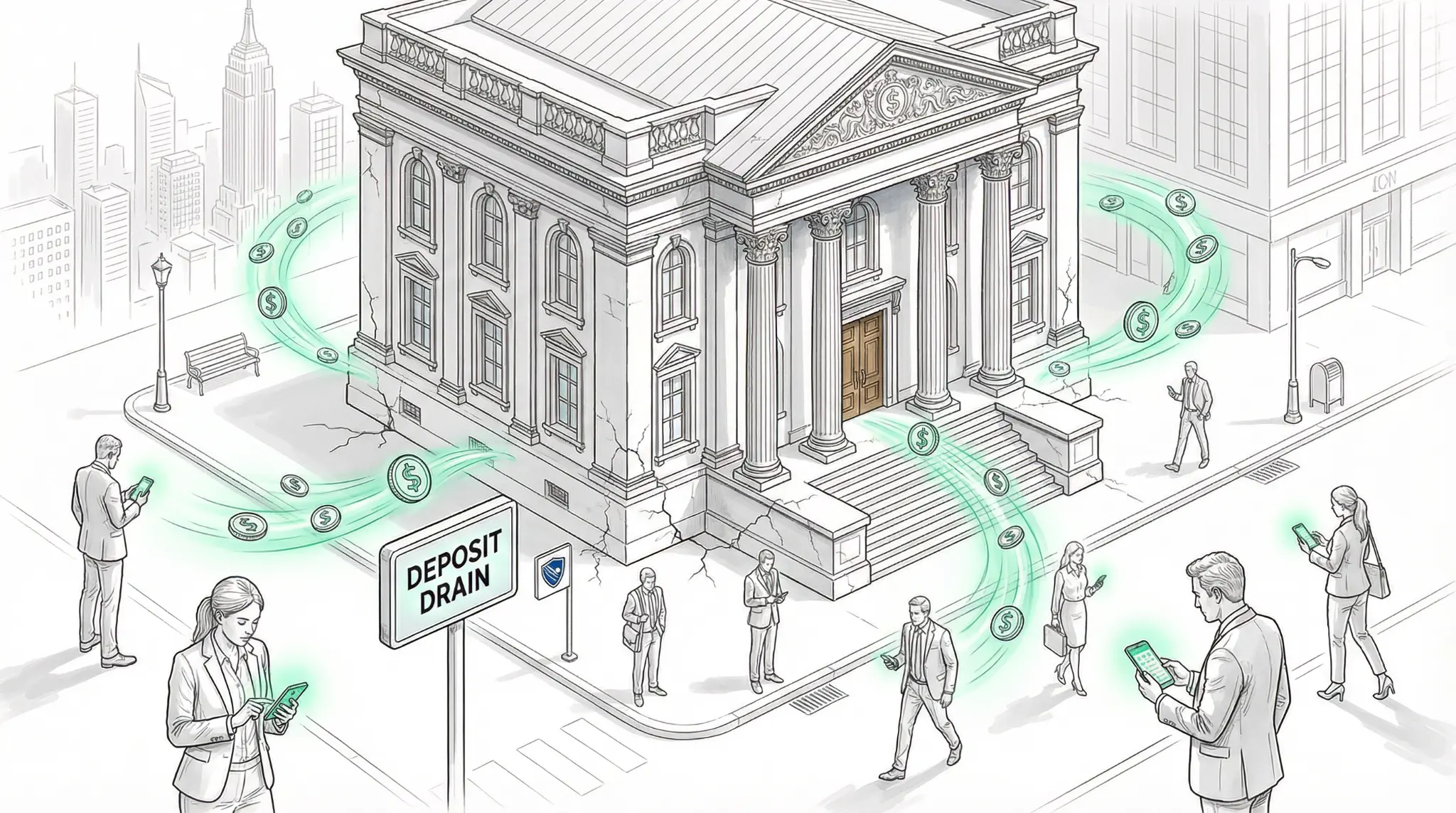

IMF Warns Stablecoins Could Drain Emerging Market Bank Deposits: The Coming Monetary Pressure

The International Monetary Fund has publicly cautioned that dollar-backed stablecoins pose a competitive threat to the monetary frameworks of emerging economies. As stablecoins gain adoption in developing nations, they could systematically drain deposits from traditional banking systems, forcing governments to strengthen their fiscal and monetary policies or risk losing control over their own financial systems.